Fictitious

capital

From Wikipedia, the free

encyclopedia

Fictitious capital is a

concept used by Karl Marx in his critique of political economy. It is introduced in

the third volume of Capital.[1]

Fictitious capital could be defined as a capitalisation

on property ownership.

Such ownership is real and legally enforced, as are the profits made

from it. But the capital involved is fictitious; it is "money that is

thrown into circulation as capital without any material basis in

commodities or productive activity".[2]

Fictitious capital could also be defined as "tradeable paper claims to

wealth", although tangible assets may themselves under certain

conditions also be vastly inflated in price.[3]

[edit] Uses of the term

Marx saw the origin of fictitious capital

in the development of the credit system and the joint-stock system.

"The formation of a fictitious capital is

called capitalisation."[4]

It represents a claim on property rights. Such claims can take many

forms, for example, a claim on future government tax revenue or a claim

issued against a commodity that remains, as yet, unsold. The stocks,

shares and bonds issued by companies and traded on stock

markets are also fictitious capital.

A company may raise (non-fictitious)

capital by issuing stocks, shares and bonds. This capital may then be

used to generate surplus value.

But once this capital is set in motion, the claims held by the owners

of the share certificate, etc, are simply "marketable claims to a share

in future surplus value production". The stock market "is a market for

fictitious capital. It is a market for the circulation of property

rights as such".[5]

Because the value of these claims does

not function as capital,

merely a claim on future surplus, "the capital-value of such paper

is...wholly illusory... The paper serves as title of ownership which

represents this capital. The stocks of railways, mines, navigation

companies, and the like, represent actual capital, namely, the capital

invested and functioning in such enterprises, or the amount of money

advanced by the stockholders for the purpose of being used as capital

in such enterprises... But this capital does not exist twice, once as

the capital-value of titles of ownership (stocks) on the one hand and

on the other hand as the actual capital invested, or to be invested, in

those enterprises." The capital "exists only in the latter form", while

the stock or share "is merely a title of ownership to a corresponding

portion of the surplus-value to be realised by it".[6]

The formation of fictitious capital is,

for Marx, linked to the

wider contradiction between the financial system in capitalism and its

monetary basis. Marx writes: "With the development of interest-bearing

capital and the credit system, all capital seems to double itself, and

sometimes treble itself, by the various modes in which the same

capital, or perhaps even the same claim on a debt, appears in different

forms in different hands. The greater portion of this 'money-capital'

is purely fictitious. All the deposits, with the exception of the

reserve fund, are merely claims on the banker, which, however, never

exist as deposits."[7]

The expansion of the credit system can, in periods of capitalist

expansion, be beneficial for the system. But in periods of economic crisis

and uncertainty, capitalists tend, Marx argues, to look to the security

of the "money-commodity" (gold) as the ultimate measure of value. Marx

tends to assume the convertibility of paper money into gold. However,

the modern system of inconvertible paper money, backed by the authority

of states, poses greater problems. Here, in periods of crisis, "the

capitalist class appears to have a choice between devaluing money or

commodities, between inflation or depression. In the event that

monetary policy is dedicated to avoiding both, it will merely end up

incurring both".[8]

[edit]

Speculation

and fictitious capital

Profit can be made purely from trading in

a variety of financial claims existing only on paper. This is

an extreme form of the fetishism of commodities in which the

underlying source of surplus-value in exploitation of labour power

is disguised. Indeed, profit can be made by using only borrowed

capital to engage in (speculative) trade, not backed up by any

tangible asset.

The price of fictitious capital is

governed by a series of complex

determinants. In the first instance they are governed by the "present

and anticipated future incomes to which ownership entitles the holder,

capitalised at the going rate of interest".[9]

But fictitious capital is also the object of speculation. The market

value of such assets can be driven up and artificially inflated, purely

as a result of supply and demand factors which can themselves be

manipulated for profit. The inflated value can just as rapidly be

punctured if large amounts of capital are withdrawn.

[edit] Illustrations

[edit] Banking

Marx cites the case of a Mr Chapman who

testified before the British Bank Acts Committee in 1857:

"though in 1857 he was himself still a

magnate on the money market,

[Chapman] complained bitterly that there were several large money

capitalists in London who were strong enough to bring the entire money

market into disorder at a given moment and in this way fleece the

smaller money dealers most shamelessly. There were supposed to be

several great sharks of this kind who could significantly intensify a

difficult situation by selling one or two million pounds worth of

Consols and in this way taking an equivalent sum of banknotes (and

thereby available loan capital) out of the market. The collaboration of

three big banks in such a manoeuvre would suffice to turn a pressure

into a panic." [10]

Marx added that:

"The biggest capital power in London is

of course the Bank of

England, but its position as a semi-state institution makes it

impossible for it to assert its domination in so brutal a fashion.

Nonetheless, it too is sufficiently capable of looking after itself...

Inasmuch as the Bank issues notes that are not backed by the metal

reserve in its vaults, it creates tokens of value that are not only

means of circulation, but also forms additional - even if fictitious -

capital for it, to the nominal value of these fiduciary notes. And

this extra capital yields it an extra profit."[11]

[edit] Public stocks

Marx writes:

"To the extent that the depreciation or

increase in value of this

paper is independent of the movement of value of the actual capital

that it represents, the wealth of the nation is just as great before as

after its depreciation or increase in value.

" 'The public stocks and canal and

railway shares had already by the

23rd of October, 1847, been depreciated in the aggregate to the amount

of £114,752,225." (Morris, Governor of the Bank of England,

testimony

in the Report on Commercial Distress, 1847-48 [No. 3800].)'

"Unless this depreciation reflected an

actual stoppage of production

and of traffic on canals and railways, or a suspension of already

initiated enterprises, or squandering capital in positively worthless

ventures, the nation did not grow one cent poorer by the bursting of

this soap bubble of nominal money-capital."[12]

[edit] See also

[edit] References

- ^

Marx,

Karl. Capital, volume III. http://www.marxists.org/archive/marx/works/1894-c3/.

- ^

Harvey,

David (2006). Limits to Capital. London: Verso. p. 95.

ISBN 9781844670956.

- ^

Itoh, Makoto;

Lapavitsas, Costas (1998), Political Economy of Money and Finance,

London and Basingstoke: Macmillan, ISBN 9780312211646

- ^

Marx,

Karl (1894), Capital, volume III, chapter 29, http://www.marxists.org/archive/marx/works/1894-c3/ch29.htm, retrieved 2008-06-26

- ^

Harvey,

David (2006). Limits to Capital. London: Verso.

p. 276. ISBN 9781844670956.

- ^

Marx,

Karl (1894), Capital, volume III, chapter 29, http://www.marxists.org/archive/marx/works/1894-c3/ch29.htm, retrieved 2008-06-26

- ^

Marx,

Karl (1894), Capital, volume III, chapter 29, http://www.marxists.org/archive/marx/works/1894-c3/ch29.htm, retrieved 2008-06-26

- ^

Harvey,

David (2006). Limits to Capital. London: Verso.

pp. 294–296. ISBN 9781844670956.

- ^

Harvey,

David (2006). Limits to Capital. London: Verso.

pp. 276–277. ISBN 9781844670956.

- ^

Marx,

Karl. Capital, volume III. Penguin. p. 674.

- ^

Marx,

Karl. Capital, volume III. Penguin. pp. 674–675.

- ^

Marx,

Karl (1894), Capital, volume III, chapter 29, http://www.marxists.org/archive/marx/works/1894-c3/ch29.htm, retrieved 2008-06-26

The Next Bubble

By Rex Moore

December 4, 2009 |

The always entertaining HowStuffWorks asks

the question, "Which economic bubble will be next to burst?"

From tulips to dot-coms to housing, the

prices investors pay for some things occasionally get totally out of

whack with their intrinsic

value. When the bubble pops, blue chips can suddenly turn red. Cisco

(Nasdaq: CSCO) and Amazon.com

(Nasdaq: AMZN)

lost far more than 60% of their value in the post-2000 tech wreck. The

entire financial landscape turned upside-down last year, and Fannie

Mae (NYSE: FNM) and Freddie

Mac (NYSE: FRE) (among

others) will never be the same.

So what might be the next asset to suffer

an Icarus-like crash?

Among the candidates: higher education, in the form of plummeting

enrollment. HSW notes that the cost of a college education has soared

440% over the past 25 years, quadrupling the rate of inflation.

"What this means is that millions of

college students are entering

an extremely tight job market saddled with tens of thousands of dollars

in high-interest debt," HSW writes. "That's not the way to start any

career. Even graduate and professional degree earners find themselves

saddled with debt that they can't possibly repay."

Next year I'll have two kids in college,

and I'm certainly feeling

the pinch. I don't think we'll see enrollment rates plummet like the

market has in the past, down 50% or more -- but I think the costs of a

higher education have to level off, or even drop, at some point in the

future.

The Higher

Education Bubble

Over

the past 25 years, the average price of a four-year college education

has risen 440 percent -- more than four times the rate of inflation

[source: Cronin].

At

the same time, more and more Americans have lined up to pay these

skyrocketing tuitions. From 1987 to 1997, undergraduate college

enrollment increased 14 percent. From 1997 to 2007, the increase was 26

percent [source: NCES].

But where is all of that tuition money

coming from? The short answer is financial

aid. The federal government offers both low-interest Stafford loans

and Pell

Grants,

which do not have to be repaid. But even those loans and grants aren't

enough to cover the four-year cost of tuition, books, room and board at

four-year colleges: nearly $47,000 for public schools and $100,000 for

private colleges and universities [source: Kristof].

Pell grants, for example, max out at $5,035 a year [source: Cronin].

For many students, the only option left

is a private student loan. These loans are largely unregulated and

carry much higher interest rates

than Federal loans. In fact, commentator Kathy Kristof of Forbes

magazine actually compares the tactics of private college lenders to

those employed by the subprime

lending market.

Kristof accuses private lenders -- and college admissions offices -- of

tricking naïve students into signing up for loans that they don't

fully

understand. Some of these loans have "teaser" interest rates that

"adjust" after graduation to levels as high as 18 percent [source: Kristof].

Compare that to the highest Stafford loan rate of 6.8 percent [source: Stafford].

What

this means is that millions of college students are entering an

extremely tight job market saddled with tens of thousands of dollars in

high-interest debt. That's not the way to start any career.

Even

graduate and professional degree earners find themselves saddled with

debt that they can't possibly repay. According to the Law School

Admission Council, the average law school debt is $100,000 [source: LSAC].

Multiply that by a double-digit interest rate and that debt becomes

very big, very fast.

There

is evidence that the college enrollment bubble is already bursting.

Two-thirds of private U.S. colleges expect lower enrollment in 2009

than 2008. They've been forced to freeze employee salaries and cut some

benefits

[sources: Hass

and Fain].

Jacob Wolinsky

More about AIG:

I have been doing a series of book reviews on the financial crisis. The

latest book that I have read is The Subprime Solution by Robert

Shiller. I was attracted to the book, after reading

Irrational Exuberance

by Dr. Shiller several years ago, which is still one of my favorite

books. The Subprime solution is not a new book. It was released in 2008

well before the financial crisis reached its peak. When I asked Dr

Shiller for the book, he told me “Subprime Solution seems to be

slipping from public attention, but it is all the more relevant now I

think.” I could not agree more.

The book can be divided into three parts:

In the first segment of the book, Shiller describes what lead to the

subprime solution. While to most investors this may seem like a review

it is useful to read Shiller’s account of what led to the subprime

problem. In addition, this section is valuable to the layman who is

unfamiliar with the course of events that lead us to the situation we

are in now. What I love about Shiller’s writing style is despite being

an academic he is able to communicate on a simple level that most

Americans would understand.

The second half of the book deals with the short term to the subprime

mess. Much of the short term fix entails essentially a bailout. Dr.

Shiller argues that these bailouts are necessary. He foresaw what would

unfold if the Government failed to act. Shiller writes “bailouts of

some sort are a necessary part of the subprime solution. To avoid an

economic crisis that would destroy public confidence and possibly lead

to systemic failure”. I only wish the Government had heeded this

warning before the collapse of Lehman Brothers. Had the Government

acted earlier it would have cost far less, and the damage to the US and

global economy would likely not have been as severe.

The third part of the book contain Dr. Shiller’s long term

solutions to avoid problems that lead to reckless subprime lending in

the future. Dr Shiller describes this as "democratization" of the

financial market.

Some of these solutions include

1. Providing lower income, and less educated people with financial

information. Shiller believes that this would have prevented many

subprime borrowers from taking out loans.

2. Specifically Shiller calls for a new financial Watchdog which

would provide people with financial information. This agency would be

similar to the consumer protection agency which protects people from

unsafe products.

3. Creating new instruments to provide people insurance in case of

their personal economic problems such as home price declines and

unemployment

The ideas contained in third part of the book, are why I believe

Shiller described the book as more relevant than ever. As the debate in

Washington about financial reform continues many ideas have been

proposed. While Shiller’s ideas might be controversial and would not

solve all the problems that led to the current financial crisis they

definitely deserve an examination. While Shiller was not the first

person to propose a financial protection agency, I believe his

endorsement of the idea may be a reason why it has become a key

platform of President Obama’s financial reform proposal.

The best part about Dr Shiller’s book is his understanding of human

psychology and how it affects the economy and can produce bubbles. As a

value investor/ contrarian, I believe human psychology plays an

important role in figuring out what investments to buy or to avoid. Dr

Shiller foresaw the subprime problems and the housing bubble long

before the full brunt of it unraveled. This is not the first time

Shiller has predicted a bubble. Robert Shiller called the stock market

bubble in the late 1990s several years before it burst.

Many people now are playing Monday morning quarterback and claiming

that the dot com bubble and housing bubbles were obvious in hindsight.

Yet, most experts including the nation’s most prestigious financial

institutions, Government agencies, academics, and investors did not

foresee either bubble. I wonder where all those people were while the

bubbles were building up- maybe buying AOL or Citigroup stock. Dr

Shiller is one of the only individuals who predicted both bubbles

before they burst. My advice is next time Dr shiller says we are in a

bubble; to take note.

For anyone following my book reviews on the financial crisis, my

next book reviews will be, Too Big to Fail By Andrew Sorkin and This

Time is Different By Kenneth Rogoff. Stay tun

January 8, 2010

Op-Ed

Columnist

Bubbles and the Banks

Health care reform is almost (knock on

wood) a done deal. Next up: fixing the financial system. I’ll be

writing a lot about financial reform in the weeks ahead. Let me begin

by asking a basic question: What should reformers try to accomplish?

A lot of the public debate has been about

protecting borrowers.

Indeed, a new Consumer Financial Protection Agency to help stop

deceptive lending practices is a very good idea. And better consumer

protection might have limited the overall size of the housing bubble.

But consumer protection, while it might

have blocked many subprime

loans, wouldn’t have prevented the sharply rising rate of delinquency

on conventional, plain-vanilla mortgages. And it certainly wouldn’t

have prevented the monstrous boom and bust in commercial real estate.

Reform, in other words, probably can’t

prevent either bad loans or

bubbles. But it can do a great deal to ensure that bubbles don’t

collapse the financial system when they burst.

Bear in mind that the implosion of the

1990s stock bubble, while

nasty — households took a $5 trillion hit — didn’t provoke a financial

crisis. So what was different about the housing bubble that followed?

The short answer is that while the stock

bubble created a lot of

risk, that risk was fairly widely diffused across the economy. By

contrast, the risks created by the housing bubble were strongly

concentrated in the financial sector. As a result, the collapse of the

housing bubble threatened to bring down the nation’s banks. And banks

play a special role in the economy. If they can’t function, the wheels

of commerce as a whole grind to a halt.

Why did the bankers take on so much risk?

Because it was in their

self-interest to do so. By increasing leverage — that is, by making

risky investments with borrowed money — banks could increase their

short-term profits. And these short-term profits, in turn, were

reflected in immense personal bonuses. If the concentration of risk in

the banking sector increased the danger of a systemwide financial

crisis, well, that wasn’t the bankers’ problem.

Of course, that conflict of interest is

the reason we have bank

regulation. But in the years before the crisis, the rules were relaxed

— and, even more important, regulators failed to expand the rules to

cover the growing “shadow” banking system, consisting of institutions

like Lehman Brothers that performed banklike functions even though they

didn’t offer conventional bank deposits.

The result was a financial industry that

was hugely profitable as

long as housing prices were going up — finance accounted for more than

a third of total U.S. profits as the bubble was inflating — but was

brought to the edge of collapse once the bubble burst. It took

government aid on an immense scale, and the promise of even more aid if

needed, to pull the industry back from the brink.

And here’s the thing: Since that aid came

with few strings — in

particular, no major banks were nationalized even though some clearly

wouldn’t have survived without government help — there’s every

incentive for bankers to engage in a repeat performance. After all,

it’s now clear that they’re living in a heads-they-win,

tails-taxpayers-lose world.

The test for reform, then, is whether it

reduces bankers’ incentives and ability to concentrate risk going

forward.

Transparency is part of the answer.

Before the crisis, hardly anyone

realized just how much risk the banks were taking on. More disclosure,

especially with regard to complex financial derivatives, would clearly

help.

Beyond that, an important aspect of

reform should be new rules

limiting bank leverage. I’ll be delving into proposed legislation in

future columns, but here’s what I can say about the financial reform

bill the House passed — with zero Republican votes — last month: Its

limits on leverage look O.K. Not great, but O.K. It would, however, be

all too easy for those rules to get weakened to the point where they

wouldn’t do the job. A few tweaks in the fine print and banks would be

free to play the same game all over again.

And reform really should take on the

financial industry’s

compensation practices. If Congress can’t legislate away the financial

rewards for excessive risk-taking, it can at least try to tax them.

Let me conclude with a political note.

The main reason for reform is

to serve the nation. If we don’t get major financial reform now, we’re

laying the foundations for the next crisis. But there are also

political reasons to act.

For there’s a populist rage building in

this country, and President

Obama’s kid-gloves treatment of the bankers has put Democrats on the

wrong side of this rage. If Congressional Democrats don’t take a tough

line with the banks in the months ahead, they will pay a big price in

November.

“Homes rose

markedly in value,

especially in hot markets like Florida and New York City. Borrowers

believed

that home purchases were no-risk ventures certain to escalade, and they

went

out on a limb to buy. Lenders who had once required large down payments

now

permitted home purchasers to combine two and three loans to buy a home.

People

took out what were called “buffet” loans, which were interest-only

loans that

buyers were told they should refinance in three years or five years.

Lenders

told home buyers not to worry; homes were rising so fast in value that

it would

always be easy to refinance into another loan. Developpers built larger

houses.

Why not? Borrowers wanted larger homes. They needed the space to hold

all the

things they were buying.” --U. S. Housing market in 1928-29, in

Kristin

Downey, The Woman Behind the New Deal (Frances Perkins), 2009, p. 106, from Gail Radford, Modern

Housing for America: Policy Struggles in the New Deal,

1996, pp.10-22

“I place

economy (saving) among the first and most

important virtues, and debt as the greatest of dangers to be

feared.” --Thomas

Jefferson: 3rd US President (1801-09)

“America is

more communist than China is right now. You can see that this is

welfare of the rich, it is socialism for the rich -- it’s just bailing

out

financial institutions. This is madness; this is insanity; they have

more than

doubled the American national debt in one weekend for a bunch of crooks

and

incompetents.” --Jim Rogers, American investor

After a

decade plus of unchecked greed by money-changers, of the political

dismantling

of financial regulation, of large “too-big-to-fail” banks made larger,

of

artificial easy money by the central bank, of the risky securitization

of all

kinds of debt instruments and of leveraged buy-outs of scores of

companies with

their own debts by financial operators, it was no surprise that the

financial

house of cards came crashing down in 2007-2008. It was like a

preprogrammed

financial crisis. A perfect financial storm.

What lessons can be drawn from the recent

unhealthy and

unpalatable past? And, what is in store for the near future,

considering that

hardly anything in the financial environment has changed? A crisis

caused by a

near total absence of financial regulation, by a too easy monetary

policy and

by too much debt, has been met with no additional financial regulation,

by an

even easier monetary policy and by even more debt. In fact, the U.S.

ratio of total debt ($57 trillion)

to the economy (GDP: $14.5 trillion in 2009) is

even higher today at 3.9, then it was before the onset of the crisis in

2007-08, when it stood at 3.4.

That is why we will argue here that the problems

of U.S.

financial dysfunction have not been solved. On the contrary, they have

been

swept under the large rug of even easier money and of even larger

debts, which

is only postponing the day of reckoning. For sure, the large Wall

Street banks’

bad debts have been transferred to the public sector (the Treasury and

the Fed)

and to the quasi public sector (Fannie Mae and Freddie Mac), but the

overall

debt load of the U.S. economy has not been reduced; it has been

increased. That

is why the U.S. is condemned to continue its foreign borrowing binge

for some

time to come.

In general, too much

foreign borrowing is bad for an economy, especially if it is done to

finance an

excessive level of domestic consumption. When this happens, it is a

sign that

total domestic expenditures (government, corporations, consumers)

exceed total

incomes. The country lives beyond its means and the gap has to be

filled with

net foreign borrowings.

The principal indicator of this situation is the current

account (a broader measure than the external trade balance) of the

country.

When a country’s current account turns negative, more money for imports

and

interest payments is flowing out of the country than is coming in

through

exports and investment income. Like any individual, of course, a

country can

borrow abroad if its credit rating is good. The question is how much

and for

how long. For countries that have fully convertible currencies or,

better, for

countries like the United States whose national currency also serves as

an international key-currency, the

situation can endure for a longer period, but there is always a day of

reckoning.

In general, for a normal economy, a negative

current account

that exceeds six (6) percent of Gross Domestic Product (GDP),

especially if

this is due to a negative trade balance, usually indicates a non

sustainable

situation of foreign borrowing and foreign indebtedness that can lead

to a financial crisis. Countries like Mexico (1994-95) and Thailand (1997-98)

experienced such a financial crisis in the 1990’s. Such was the case

also with Argentina

at the turn of the century.

Since 2000, and coinciding with the arrival of the

George W.

Bush Republican administration, the United States has also embarked

upon a

policy of excessive domestic spending, resulting in larger and larger

and

persistent current account deficits and huge foreign borrowings.

Indeed, the

adoption of an imperial foreign policy of

permanent war throughout the world, financed on credit, and an

ideological

preference for large fiscal deficits, have translated into large

American

current account deficits.

In 2006, the U.S. (external) current account

deficit reached

6.5 percent of GDP. This was the apex of external debt sustainability

and a

harbinger of economic troubles to come for the U.S. economy. As a

matter of

fact, this induced me to write an article on October 16, 2006 entitled “Headwinds

for the US Economy,” in

which I warned that it was a “matter of months, not years,” before the U.S. economy and the U.S.

dollar begin to experience some downward pressures. I repeated the

warning a

few months later when I wrote on May 5, 2007, (A

Slowdown or a Recession in the U.S. in

2008?), that we could

expect “the collapse of one and possibly several major financial

institutions under the pressures of bad loans and record foreclosures .

. . The

rate of foreclosure is bound to spike in the coming months, possibly

culminating in the next two years into a financial hurricane.” This

was said

many months before the onset of the 2008-09 recession and the September

15,

2008, failure of the large investment bank Lehman Brothers.

In 2008, in the midst of the economic recession,

the U.S.

current account deficit was still estimated at –$706 billion (nearly

all caused

by a –$707.8 billion trade deficit) for a $14,441 U. S. GDP, that

translated

into a 4.9 percent current account deficit relative to the economy.

With the 2008–09 economic crisis and recession,

the US

current account deficit has since been somewhat reduced due to a drop

in

incomes and in imports, and partly due to a sharp decline in oil

prices, but it

is expected to remain above four percent of GDP. In the coming years,

this

ratio is likely to increase again as the long-term U.S. fiscal deficit

is

expected to remain at 10 percent of GDP for years to come.

The Fed’s Role in

creating asset price bubbles

The causes of a financial crisis are complex and

can vary

from one country to the next. In general, however, they usually stem

from the

central bank becoming subservient to the government when the latter

decides to

embark upon a policy of large fiscal deficits. If the central

government opts

in favor of monetizing the public deficits and keeping interest rates

low, an asset bubble is bound to emerge.

Unfortunately, that’s pretty much what the

Greenspan Fed

elected to do in maintaining an easy money policy for too long and in

keeping

interest rates too low, for too long, in the late 1990s and in the

first part

of the 2000 decade. Indeed, most economists agree that in 2003-04, the

U.S. Fed

should have raised short-term interest rates (pushed down to 1 percent

in June

2003 from 6.5 percent in December 2000). But the then Greenspan Fed

(current

Fed Chairman Ben S. Bernanke has been a Fed Board member since 2002)

was deeply

embroiled in the Bush political agenda. Chairman Alan Greenspan

publicly

acknowledged this fact when he declared on September 17, 2007, in an

interview

with the Financial Times, that “raising interest rates sooner and

faster (before

the 2004 presidential election) would not have been acceptable to

the

political establishment given the very low (official) rate of

inflation.”

In financial matters, the American central bank

(the Fed or the Federal Reserve System)

is a curious animal. It is an institution that is entrusted to regulate

banks

and other financial institutions, but it is partly owned by the large

money

center banks. It is in a perpetual conflict of interests. In fact, it

can be

said that the Fed is the banks’ own private government. In good times,

large

Wall Street banks, bank holding companies and other large integrated

financial

groups, such as AIG (American International Group), are pretty much

left alone

and allowed to build profitable but risky and shaky financial pyramids,

with

scant supervision. When things go bad, however, the Fed stands ready to

bail

them out with automatic discounting, zero-interest loans and other

goodies, the

overall cost being transferred to the general public through an

inflation tax and

a debased currency. We know since 2008 that the U.S. Treasury also

stands ready

with public money to bail out the large Wall Street banks when their

gambles go

sour. The $700 billion Troubled Assets Relief Program (TARP)

is testimony to that effect.

A central bank can always print new money. But

this is

hardly a magic recipe for prosperity. If it were so, many Third World

countries

could claim to have discovered this magic potion. The current Bernanke

Fed is

tragically wrong in its belief that it can reverse the current

over-indebtedness situation in the economy and its mismanagement of the

financial crisis by printing money. It is not true that the real

economy always

respond positively to heavy doses of monetary stimulus. In fact, the

contrary

is usually the case. If it were true, Zimbabwe, which is an African

economic basket case with an uncontrolled bout of hyperinflation, would

be

prosperous. The U.S. economy is not exempt from fundamental economic

laws. A

few years down the road, people will see why.

It is my feeling that the U.S. economy is

presently in the

eye of a powerful financial hurricane of debt

liquidation. Such systemic crisis happens no more than

twice in a century and it takes at least a decade to work itself out.

In this

environment, one should be wary of the stock market as a barometer of

the real

economy. There could be artificially created short-term “liquidity”

rallies,

when all the while the real economy remains in the doldrums. The 2009

liquidity-driven stock market rally has all the appearances of such a

bear

market rally destined to fail and trap many unwary investors. In fact,

this

rally looks like a mirror repeat of the 1930 stock market rally that

saw stocks

retrace some 50 percent of their initial 1929 losses. We know now that

this was

only a mirage, and that the worst was still to come.

In my last July

10 blog, I stated that there

is likely to be a prolonged 2007-2017 economic stagnation period in the

U.S. I

reconfirm this assessment, which is reinforced by my conviction that

the

Bernanke Fed is making matters worse by its unlimited printing press

so-called

“solution” of discounting everything but the kitchen sink. It is my

contention

that this imprudent Fed is paving the way for the mother lode of bubble

and

subsequent crash. This is because, as alluded to above, they seem to

have

forgotten that the credit cycle and the process of

debt build-up, and the subsequent debt liquidation that follows, are

the

primary driving forces in the underlying economic cycle.

This time the crash will be initiated in the huge bond

market, will spread to the commercial loan market and

ultimately to the stock market, and then will further crush the real

economy in

a way that few understand today but will learn the hard way in the

coming

years.

Let us keep in mind that in the recent past, the

Fed and the

U.S. Treasury did not see the subprime and housing crises coming. They

were

completely taken off-guard. In 2005, according to then Fed member Ben

Bernanke,

“there was no housing bubble,”

even though everybody and his uncle could see that the real estate

bubble was

about to burst.

And now, let us look at the figures. At the end of

2009,

reflecting a binge of printing new money by the Fed, the U.S. monetary base,

i.e.

money circulating through the public and banking reserves on deposit

with the

Federal Reserve, stood at more than $2,016,136,000,000, after having

increased

146 percent in three years. This is unprecedented. —Even if one

subtracts the

inactive excess bank reserves at the Fed, worth more than $1 trillion

(and

earning interest!), the U.S.’s monetary base has grown 22 percent in

three

years, from a starting point of $818 billion in early 2006.

Nevertheless, Fed Chairman Ben Bernanke said in

2009, that

he does not fear inflation and that, in fact, inflation could even go

down from

then on. He could be right for the next few months, but how about the

next few

years?

Those who listened to Chairman B. B. in 2005, and

kept

buying leveraged real estate, lost their shirt. I am of the feeling

that those

who believed Chairman B.B in 2009, and kept buying long-term U.S.

Treasury

bonds, are also going to lose their shirt. Because of the huge federal

deficits

and Fed policy to monetize a big chunk of them, U.S. long-term rates

are bound

to increase in the coming years, whether the real economy grows or not.

That

would be the next Fed-created bubble bursting, the bubble of

artificially low

interest rates, excessive money creation and artificially high asset

prices for

long-term Treasury bonds.

In the past, the big losers of this policy were

the millions

of people who lost their homes through mortgage foreclosures, the

millions of

people who lost their jobs through bankruptcies and the millions of

retirees

who saw their retirement incomes plummet with near zero interest rates.

In the

future, the principal losers will still be middle class families who

will

continue being the victims of a massive spoliation and will still have

trouble

making ends meet, plus retirees whose retirement capital will be

further

eroded. Where is AARP when we need it?

Rodrigue

Tremblay lives in Montreal and can be reached at rodrigue.tremblay@yahoo.com. He is the author of the book

“‘The New American Empire.” Check out his

new book, “The

Code for Global Ethics. Visit his blog site at thenewamericanempire.com/blog.

Copyright ©

1998-2007 Online Journal

Nouriel Roubini Predicts Gold Bubble Will Burst

Published on:

Monday,

December 21, 2009

Low interest rates,

over-sized leverage and increased deficit spending have all contributed

to the continued rise of gold prices. Still, some experts believe that

the current gold bubble will collapse as the global economy starts to

slowly recover, and the US dollar comes back into favor. For more on

this, see the following article from Bullion Vault.

Nouriel

Roubini was "one of the few to predict the financial crisis" reckons

the Financial Times. Yet plenty of other chicken littles, amateur and

professional, had long warned of trouble ahead, too.

Hence the 150% rise in Gold even before the crisis broke in August

2007. Set against negative real interest rates, unfettered bank

leverage and runaway deficit spending, gold's rare physical persistence

looked a fair bet. And absent Armageddon or double-digit inflation, a

growing handful of people chose to store a chunk of their change in

metal, starting around 2001.

Oh sure, gold has since outstripped the S&P's best-ever run of

year-on-year gains (1982-1989). It's not fallen for more than two

consecutive months either since April '01. But clearly, back then, and

long before our present troubles showed up, these people were nuts!

At least, in Roubini's world they were. Which brings us right up to

date.

This decade's three gold-friendly trends – of sub-zero rates,

over-sized leverage and relentless state deficits – remain firmly in

place. Sadly for fixed-income investors (i.e. everyone now or soon to

be retired), the first and the third look set to blow up together,

sooner or later. Quite when, who can be sure? But the quietly

broadening move towards gold (Glenn Beck aside) rolls on as well. And

so too, oddly, does the idea that Gold only rises on the back of

runaway inflation in consumer prices...or a wipe-out Armageddon in

stocks and bonds.

Those two eventualities would likely push gold sharply higher from

here. We might just get them all at once if current trends persist for

much longer. Better to take a position ahead of time, you might guess.

But no. Not if you're smart like Roubini.

"With no near-term risk of inflation or depression, why have gold

prices started to rise sharply again in the last few months?" asks

Dr.Doom himself of his RGE Monitor clients. Without those extreme

events, this fall's rise in the gold price must be a bubble, he says.

"When inflation is high and rising, gold becomes a hedge against

inflation; and when there is a risk of a near depression and investors

fear for the security of their bank deposits, gold becomes a safe

haven."

So far, so fair. But Gold's performance from 2003-2007 – when it rose

alongside everything else except the Dollar – shows that true chicken

littles tend to move early. Inflation hedging is wasted if you wait

until inflation has struck. Safe haven hoarding comes too late once the

depression's begun. That's why, we guess, ever-more chicken littles

continue to buy gold regardless of what the latest data might say.

Because the coming collapse of the sky won't show in your rear-view

mirror. Not unless, like a good many "gold bugs", you actually crane

your neck round...and squint at history to help guide your driving

through what are proving historical times...

"Money printing typically leads to inflation; excessive leverage tends

to blow up. Governments can in fact become bankrupt. The center of

power rarely sits still for a century or more..."

The problem, of course, is that gold pays no income and earns no

quarterly cashflow. That makes it invaluable on contemporary metrics, a

fact most pundits mistake for worthless. And "Since gold has no

intrinsic value," says Dr.Doom, bounding ahead of his error, "there are

significant risks of a downward correction."

Yes, he acknowledges six basic reasons why Gold continues to rise. To

save space – and show just why they might matter – we'll summarize

Roubini's bull case as:

- money printing;

- bank leverage;

- the Dollar;

- falling mine output;

- Asian gold hoarding; and

- the ultimate "too big to save" of government itself.

Against this, however, Roubini foresees

an end to quantitative

easing and zero rates, buoying the Dollar. Or perhaps "the global

recovery may turn out to be fragile and anemic, leading

to...bullishness about the US Dollar." Or failing that, "the

Dollar-funded carry trade may unravel, crashing the global asset

bubble...together with the wave of monetary liquidity it has caused."

You will have spotted the common denominator. Massed against the six

trends Roubini himself puts in gold's favor, the US Dollar will

prevail. One way or the other. Perhaps. Either way, gold's recent rise

to $1200 an ounce – let alone its jump to fresh all-time highs vs. all

other currencies barring the Aussie Dollar and Japanese Yen – must be a

bubble.

Because Gold, unlike the Dollar, has "no intrinsic value". Or so says

Roubini.

I

don't know how much clearer it gets than this:

By Scott Lanman and Craig Torres

Jan. 7 (Bloomberg) -- U.S. regulators including the Federal

Reserve warned banks to guard against possible losses from an

end to low interest rates and reduce exposure or raise capital

if needed.

“In the current environment of historically low short-term

interest rates, it is important for institutions to have robust

processes for measuring and, where necessary, mitigating their

exposure to potential increases in interest rates,” the Federal

Financial Institutions Examination Council, which includes the

Fed, Federal Deposit Insurance Corp. and other agencies, said in

a statement today.

Let me point out a few things.

-

We have never

seen a crash and rebound in US stock market history like what we have

just experienced, except once. That "once" was 1929/1930. What

followed next was a grueling grind - not a crash, but a grind that

never ended, and in which the market lost more than 80% of its value. Those

who

argue "the bigger the dive the bigger the bounce" forget that the

only true comparison against what we have just seen was in fact the

prelude to a grinding 90%+ overall decline.

-

If you believe in "long wave" cycles - that is, Kondratieff

cycles, we have precisely followed

the several-hundred-year long pattern though its latest incarnation,

with the 1982-2000ish period being "Autumn." Winter follows fall. These

cycles seem to happen mostly because all (or essentially all) of the

people who lived through the last cycle's horrors are dead. Unless we

have found a way to break a cycle that has endured far longer than our

nation, we're right where we should be - which incidentally aligns with

what happened in 1929/30 as well. This means that while there may be

ups and downs we have not bottomed - not by a long

shot - no matter what people tell you.

-

Interest

rates can only go up from zero. That should be obvious. Rising rates

are not positive for equities and multiple expansion.

-

The Financials are getting a tremendous

bid the last few days, presumably on the premise that "employment is at

least somewhat stabilizing." With zero short rates and a steep yield

curve, this means they make a lot of money. But rates cannot

stay where they are if in fact the economy is recovering, and if the

long end rises it will choke off housing.

-

At the same time people are rotating into a sector The

Fed and regulators just said will be forced to constrain its profits

people are fleeing the stocks (tech) that have been

on a tear. This is exactly backward

based on the news flow. Are The Fed and Regulators lying or is the

"optimism" incredibly misplaced (and even stupid if they're rotating

out of winners for what were just announced would be losers!)

-

P/Es are at record

levels. Yes, that's on "as reported" 12 month trailing, and it is down

materially since one of the two "disaster quarters" is now gone. But

even with the other gone (which it will be in another month) we

will

be trading at somewhere around 40 or 50x earnings, an utterly

unsupportable level and above where we were in 1999 - just before the

entire market fell apart. Even on "operating earnings" we're

trading at 24 times - outrageously overvalued from a historical

perspective.

We

also have the BIS calling in bankers to warn them that they've

changed nothing in their behavior (gee, really?) and China

making a serious attempt to pop their property bubble (must be nice

to actually pay attention to such things, eh?).

For today, "party on Garth" in equities.

Let me simply remind people that what got me writing The Market

Ticker was this event - something that I missed the signs of because

I was overly complacent, just as people are being right now.

That was 2006 and into 2007, remember?

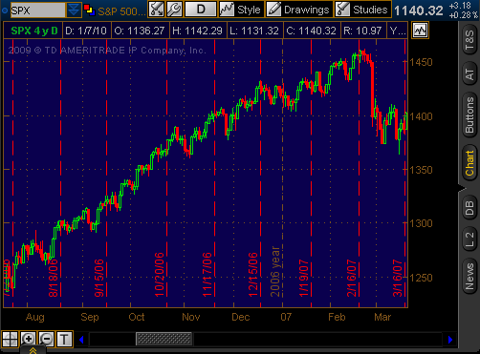

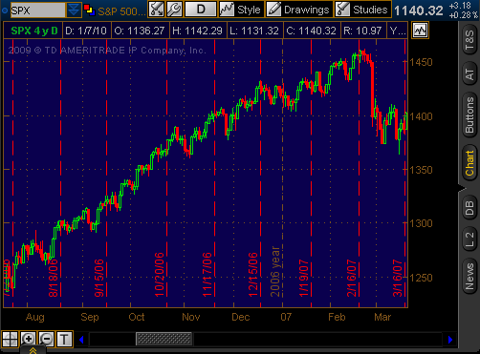

Straight

up - right up until it wasn't, and 60 SPX points came off in one day.

That warning (and mine when I started writing) was ignored by a whole

lot of people too who thought it was a "blip."

Uh, no, it was a warning and those who failed to heed it got their

heads handed to them.

Don't

worry folks, it can't happen again. Remember, The Fed has our back,

just as they did in 2006 when they told us there was nothing to worry

about in the summer when we got the swoon (remember that? I do - and

bought into it!).

The picture now is actually worse

than it was in early 2007. In early 2007 we had solid employment, we

still had a reasonable housing market although it had slowed some, GDP

was positive and we had just come off a GREAT

Christmas season with extraordinary profits and sales. In addition we

were running ~350 billion in deficits, not $1.6 trillion (estimated for

FY10) nor did we have to roll and issue over $2 trillion of treasury

debt (to someone!) in the next 12 months.

Now we have the regulators issuing formal warnings about bank

liquidity and interest rate risk (no

really, you think that might be an issue with that sort of issue

behavior?) while at the same time formal liquidity support in the form

of monetization along with stimulus spending is slipping away - the

source of the liquidity that fueled the rally from March.

Ignore all this if you're brave - or stupid.

PIMCO isn't. Bill Gross sees the same thing I see.

Nouriel Roubini Was Wrong, Again, and Again and

Again...

Update

10/30/09: Oil has climbed above $80 per barrel this month so Roubini's

January prediction that it would stay below $40 for all of 2009 ain't

lookin too sharp just now. And, nothwithstanding this past week's

correction, stocks have been strong since late winter...so Roubini's

prognostication that this is a sucker's rally also isn't looking too

sharp right now. The S&P 500, which he predicted would sag to 600

has surged above 1000.

Update 3/23/09: Last fall, I kept

hearing about economist Nouriel Roubini, who supposedly predicted the

financial crisis. He was all over the cable television circuit claiming

that he had predicted the myriad horrible things that were happening. I

wrote the following piece on October 24th because his prediction that

hedge fund selling would force regulators to close world stock markets

for one to two weeks was absurd. It was indeed absurd and of course,

never happened. Roubini was wrong. In researching his past predictions

over preceding years, I was struck by how many were wrong. If the

economy continues to improve as the year goes on, it will be

interesting to see how Roubini will try to explain the myriad negative

predictions he has continued to make in recent weeks and months.

(Here's another recent Roubini prediction: in mid-January, Roubini

predicted oil prices would stay below $40 per

barrel for all of 2009. Oil has now gone back above $50 per barrel -

wrong, again!)

Some additional recent Roubini predictions which are quite likely to be

wrong are his early March, 2009

predictions that the recession will last through

late 2010 and his other

prediction

that the S&P 500 Index was highly likely to fall below 600 (at the

time he said this in early March, it was at 676 and rallied strongly

since). He has been widely

quoted as referring to the stock market rally as a

sucker's rally.

"Panic

over hedge funds could close markets," says the bold headline in The

Times, a large London newspaper on Friday October 24, 2008. The

article

states that Nouriel Roubini, a professor at New York University, told a

London investment conference audience that "...hundreds of hedge funds

are poised to fail as frantic investors rush to redeem their assets and

force managers into a fire sale of assets...We've reached a situation

of sheer panic. Don't be surprised if policymakers need to close down

markets for a week or two in coming days." Roubini went on to say,

"Things will get much worse before they get better. I fear the worst is

ahead of us." Those are pretty bold and scary predictions. Telling

investors that the worst is yet to come after global stock markets have

been hammered down by about half since late 2007 is pretty amazing.

Roubini

has been getting tons of press of late for having supposedly predicted

the financial mess that unfolded in 2008. A recent Bloomberg article

said, "Roubini predicted in July 2006 that the U.S. would enter an

economic recession. In February this year, he forecast a ‘catastrophic'

financial meltdown that central bankers would fail to prevent, leading

to the bankruptcy of large banks exposed to mortgages and a ‘sharp

drop' in equities."

Before I listen to or follow the advice of

anyone making predictions, I want to know that person's track record

and background. So I researched Roubini's background and his actual

economic forecasts (not his claims) and here's what I found.

Roubini

earned his undergraduate degree at Bocconi University in Milan, Italy

in 1982. He grew up in Italy after his Iranian parents moved around to

Istanbul, Tehran and Tel Aviv.

According to his consulting

firm's web site, "Professor Roubini served as a senior adviser to the

White House Council of Economic Advisers and the U.S. Treasury

Department"

That sounds impressive but on the web site for the

NYU Stern School of Business (where he teaches) it says, "He was also

the Senior Economist for International Affairs at the White House

Council of Economic Advisers from 1998-1999; then, the Senior Advisor

to the Under Secretary for International Affairs and the Director of

the Office of Policy Development and Review at the U.S. Treasury

Department from 1999- 2000." That sounds a lot less impressive.

As

for Bloomberg crediting Roubini for predicting the current financial

meltdown, stock market plunge and recession, some perspective is in

order. Back in the summer of 2006, Roubini spoke at an International

Monetary Fund event and predicted an imminent U.S. recession according

to economist Anirvan Banerji who participated with Roubini in a panel

discussion. A transcript of that event shows that Roubini did not

predict a market meltdown or any of the other problems he now claims to

have predicted as quoted by Bloomberg. Banerji says that Roubini

predicted a recession in 2004 caused by U.S. trade deficits, federal

reserve interest rate hikes and high oil prices. (His recession calls

dating back to at least 2004 is verified by a Business Week article

I'll get to in a moment).

In 2005, Roubini saw Hurricane Katrina

and high oil prices causing a U.S. economic slowdown. "This is a very

delicate moment. The economy is already very imbalanced. On top of

that, we've had a massive oil shock and now we have a natural disaster

that might be something of a tipping point."

Here's another

quote with Roubini's poor predictions from an article on his own

business school's web site: "Among those sporting a red face at

Christmas dinner was Nouriel Roubini...Roubini was featured in The

Enigmatic Greenback, specifically suggesting the US dollar was in an

"anti-gravity" phase that was about to reverse. He has kicked off 2006

with a mea culpa, admitting that he had indeed called 2005 incorrectly.

Dispirited? No way. Roubini is back and he's not taking a backward

step. 2006 will be the year of the US economic slowdown, and thus the

global economy will hit slowdown as well."

And, then there's

this article from Business Week, which states, "Nouriel Roubini, an

economist at New York University who was worried about a global

recession in 2004, is now predicting that "the U.S. is heading toward a

sharp recession by early 2007."

So there you have it. Roubini

predicted a recession in 2004, 2005, 2006, and 2007. He was wrong four

years in a row. So, in 2008, his prediction appears to be finally

coming true. Well, a stopped clock is correct twice each day and as

Banerji says, "Roubini is the Boy Who Cried Wolf."

So, let's now

return to the alarming headline in The Times publication which rattled

markets on Friday October 24th with Roubini predicting further plunging

stock prices from already low levels and panic so bad that regulators

would close stock markets for one to two weeks. Let's think about the

premise of his prediction that "...hundreds of hedge funds are poised

to fail as frantic investors rush to redeem their assets and force

managers into a fire sale of assets..."

Consider who invests in

hedge funds and how hedge funds invest money. Hedge fund assets

primarily come from institutional investors (e.g. large university

endowments, corporate pension plans) and wealthy individuals who

typically invest one million dollars or more. Hedge fund investors

aren't stupid and aren't going to head for the exits in unison. Also

consider the fact that many hedge funds sell stocks and other assets

short so that when prices fall, as they have in 2008, they profit.

Are

investors pulling money out of some hedge funds with which they are

dissatisfied with performance? Of course that's happening as it does

with other investment vehicles such as mutual funds or exchange-traded

funds. That's not going to lead to a further collapse in already highly

depressed stock prices.

Money management is a highly competitive

business and chronically poor performing firms get punished with

redemptions and better performing companies get rewarded with more

money to manage. For sure, some hedge are liquidating assets which adds

to the selling pressure in various marketplaces (or buying pressure if

they are covering short positions) as particular hedge funds are

closing up shop while some others are seeing assets go out the door.

All assets have to go somewhere and smart money managers buy sound

investments that are selling at favorable valuations.

The sad

part about hyped articles with hyped predictions is that it causes some

individual investors to panic and do the wrong thing - selling good

assets like stocks at depressed prices. The media shouldn't

irresponsibly publicize hyped predictions, especially without clearly

and accurately disclosing the predictor's track record. Don't fall

victim to such hype.

Richard Bernstein's 10 Predictions For 2010

Here are my 10 guesses for how

the financial markets will shape up in 2010.

Here are my 10 guesses for how

the financial markets will shape up in 2010.

1. Stock

and

bond

market returns in the US will again be positive.

2. The US

dollar

is likely to meaningfully appreciate once market-driven short-term

rates begin to rise.

3. US dollar “carry trades” could get killed as 2010

progresses and the US dollar appreciates. Once

accounting for leverage, hedge fund performance will likely trail

long-only equity performance.

4. The Fed will spend the second half of the year trying to

catch up to, and flatten, the yield curve. Short-term

rates could increase more than investors

currently think. Long-term rates could rise quite a bit in the

first

part of the year as inflation finally begins to appear, but are likely

to fall during the second half of the year when the markets realize the

Fed is serious about fighting inflation. The curve is likely to

be

much flatter one year from today than it is currently.

5. Corporate profits are likely to explode to the upside

during 2010.

Trailing four-quarter S&P 500 reported earnings growth could exceed

100%. Investors still seem to be under-estimating the operating

and

financial leverage that is built into corporate profits.

6. Employment in the US will probably continue to

improve. Consumer Discretionary stocks will likely be

among the best performing sectors.

7. Treasuries will probably underperform stocks.

That

underperformance is unfortunately likely to reinforce both

individual and institutional investors’ views that it is wise to be

under-diversified.

8. Small cap value, I think, will be the US’s best

performing size/style segment. Small banks

outperformance might be the biggest surprise for 2010.

9. Financial regulation will progress, but the bull market

will probably aid politicians’ “forgetfulness”.

As a result, new regulation could be relatively meaningless. In

my

opinion, serious regulation won’t occur until after the next downturn,

which could be worse if no meaningful new regulation is implemented in

2010.

10. I think the Democrats will do better in the 2010

mid-term elections than people currently think they will.

It

seems very likely to me that in December 2010, investors will look

back on the year and realize that monetary and fiscal policy stimulus

still works.

Motley Fool Says Ignore Stock Market Forecasts and

Predictions for 2010, But...

Stock-Markets

/

Financial

Markets 2010 Dec 24, 2009 - 12:57 PM

By: Nadeem_Walayat

A recent email titled "3 Reasons You

Should Ignore Predictions for 2010"

from the popular UK personal finance website Motley Fool perked my

interest. My immediate thought was wow are they going to state that the

real secret of successful trading is to react to price movements in

real time, and if so what are the other 2 reasons?

A recent email titled "3 Reasons You

Should Ignore Predictions for 2010"

from the popular UK personal finance website Motley Fool perked my

interest. My immediate thought was wow are they going to state that the

real secret of successful trading is to react to price movements in

real time, and if so what are the other 2 reasons?

Leaving aside for the moment the contradiction in the preceding

day's email also an from Motley Fool titled "6

predictions for 2010", and several more subsequent emails along

the same lines.

Firstly, I don't like the word PREDICTION as no one can PREDICT

the future, all one can attempt to do by means of in depth analysis is

to arrive at

a scenario that projects / forecasts trends based on probabilities.

Motley Fools Reasons of why you should ignore predictions

for 2010 and What you should do instead.

Motley Fool

1. No one -- no analyst, no economist,

no politician, no academic, and no investor -- predicted with precision

the 22% drop in the FTSE 100 from 1 January 2009 to 9 March 2009.

FTSE 100 Index Stock Market Forecast 2009

- 22nd January 2009

FTSE 100 Index Mid 2009 Low 3400 - 70% Confidence;

End 2009 at 4,600 (During December 2009) - 70% Confidence

2. The second reason you shouldn't give much heed

to predictions for 2010 is that the forecasters will alter their

predictions as the year unfolds.

They are correct, forecasts have to be revised, but not for the

reasons alluded to for the fulfillment of a target i.e. in this case

for the FTSE low of 3,400 being fulfilled in March 2009 DID call for an

update.

17 Mar 2009 - FTSE 100 Index

Stealth Bull Market as Bear Market Bottoms at 3,460

This article is a quick update which includes

summaries of recent analysis and the initial FTSE buy triggers for what

I expect will turn out to become a multi-year bull market whilst the

vast majority of market participants (small investors / analysts) FAIL

to recognise the stealth bull market now underway until many months and

a good 30% rally has already taken place as the perma bears that have

enjoyed much press coverage as the bear market raged WILL continue to

convince most investors from failing to participate, leaving only the

smart money, i.e. hedge funds, fund money pools and yours truly to

accumulate.

3. The final reason you shouldn't

give much heed to predictions for 2010 is that the forecasters have no

accountability for their predictions.

Yes, no one wants to be reminded of wrong market calls, for at

the end of the day the future is unwritten and events that some call black

swans can change subsequent market trends (though black

swans are

more often used to explain away poor analysis) which DOES mean one

needs to continuously analyse the markets one trades or invests in. It

is never a case of fire and forget, but more along the lines of

creating a scenario and then performing periodic in depth updates as

targets are achieved and triggers are hit.

However clearly, not all analysis and hence forecasts are of

the same caliber, therefore IT IS important that past market calls ARE

evaluated on subsequent price action as we at the market oracle are

undertaking through exercise of allowing all site visitors to VOTE on the

Accurate Forecast Articles Published between Sept 2008 to Sept 2009.

As

those that did get it right during 2009 have a greater probability

of getting it right for 2010. I say probability for at the end of the

day that is all a forecast can be, i.e. NOT a PREDICION OF AN EVENT,

But a % probability of an scenario transpiring.

Now after the Motley Fools discrediting of ALL future

Predictions / Forecasts for 2010 (presumably including their own), what

do they advise readers should do ?

Pay £29.50 for their 10 share picks of 2010 (predicting these

stocks will rise in price).

As for where I think the stock market is

headed during 2010?

The analysis has been underway that will culminate in final

conclusions / forecast trends in the following sequence - Inflation,

economy, interest rates, housing, stocks, other markets. To receive the

analysis in your email box on completion, ensure

you are subscribed to my always FREE newsletter.

By Nadeem Walayat

http://www.marketoracle.co.uk

Copyright © 2005-09 Marketoracle.co.uk (Market

Oracle Ltd). All rights reserved.

Nadeem Walayat has over 20 years experience of trading

derivatives, portfolio management and analysing the financial

markets, including one of few who both anticipated and Beat the

1987 Crash. Nadeem's forward looking analysis specialises

on the housing market and interest

rates. Nadeem is the Editor of The Market Oracle, a FREE Daily

Financial Markets Analysis & Forecasting online publication. We

present in-depth analysis from over 400 experienced analysts on a range

of views of the probable direction of the financial markets. Thus

enabling our readers to arrive at an informed opinion on future market

direction. http://www.marketoracle.co.uk

Motley Fool Says Ignore Stock Market Forecasts and

Predictions for 2010, But...

Stock-Markets

/

Financial

Markets 2010 Dec 24, 2009 - 12:57 PM

By: Nadeem_Walayat

A recent email titled "3 Reasons You

Should Ignore Predictions for 2010"

from the popular UK personal finance website Motley Fool perked my

interest. My immediate thought was wow are they going to state that the

real secret of successful trading is to react to price movements in

real time, and if so what are the other 2 reasons?

A recent email titled "3 Reasons You

Should Ignore Predictions for 2010"

from the popular UK personal finance website Motley Fool perked my

interest. My immediate thought was wow are they going to state that the

real secret of successful trading is to react to price movements in

real time, and if so what are the other 2 reasons?

Leaving aside for the moment the contradiction in the preceding

day's email also an from Motley Fool titled "6

predictions for 2010", and several more subsequent emails along

the same lines.

Firstly, I don't like the word PREDICTION as no one can PREDICT

the future, all one can attempt to do by means of in depth analysis is

to arrive at

a scenario that projects / forecasts trends based on probabilities.

Motley Fools Reasons of why you should ignore predictions

for 2010 and What you should do instead.

Motley Fool

1. No one -- no analyst, no economist,

no politician, no academic, and no investor -- predicted with precision

the 22% drop in the FTSE 100 from 1 January 2009 to 9 March 2009.

FTSE 100 Index Stock Market Forecast 2009

- 22nd January 2009

FTSE 100 Index Mid 2009 Low 3400 - 70% Confidence;

End 2009 at 4,600 (During December 2009) - 70% Confidence

2. The second reason you shouldn't give much heed

to predictions for 2010 is that the forecasters will alter their

predictions as the year unfolds.

They are correct, forecasts have to be revised, but not for the

reasons alluded to for the fulfillment of a target i.e. in this case

for the FTSE low of 3,400 being fulfilled in March 2009 DID call for an

update.

17 Mar 2009 - FTSE 100 Index

Stealth Bull Market as Bear Market Bottoms at 3,460

This article is a quick update which includes

summaries of recent analysis and the initial FTSE buy triggers for what

I expect will turn out to become a multi-year bull market whilst the

vast majority of market participants (small investors / analysts) FAIL

to recognise the stealth bull market now underway until many months and

a good 30% rally has already taken place as the perma bears that have

enjoyed much press coverage as the bear market raged WILL continue to

convince most investors from failing to participate, leaving only the

smart money, i.e. hedge funds, fund money pools and yours truly to

accumulate.

3. The final reason you shouldn't

give much heed to predictions for 2010 is that the forecasters have no

accountability for their predictions.

Yes, no one wants to be reminded of wrong market calls, for at

the end of the day the future is unwritten and events that some call black

swans can change subsequent market trends (though black

swans are

more often used to explain away poor analysis) which DOES mean one

needs to continuously analyse the markets one trades or invests in. It

is never a case of fire and forget, but more along the lines of

creating a scenario and then performing periodic in depth updates as

targets are achieved and triggers are hit.

However clearly, not all analysis and hence forecasts are of

the same caliber, therefore IT IS important that past market calls ARE

evaluated on subsequent price action as we at the market oracle are

undertaking through exercise of allowing all site visitors to VOTE on the

Accurate Forecast Articles Published between Sept 2008 to Sept 2009.

As

those that did get it right during 2009 have a greater probability

of getting it right for 2010. I say probability for at the end of the

day that is all a forecast can be, i.e. NOT a PREDICION OF AN EVENT,

But a % probability of an scenario transpiring.

Now after the Motley Fools discrediting of ALL future

Predictions / Forecasts for 2010 (presumably including their own), what

do they advise readers should do ?

Pay £29.50 for their 10 share picks of 2010 (predicting these

stocks will rise in price).

As for where I think the stock market is

headed during 2010?

The analysis has been underway that will culminate in final

conclusions / forecast trends in the following sequence - Inflation,

economy, interest rates, housing, stocks, other markets. To receive the

analysis in your email box on completion, ensure

you are subscribed to my always FREE newsletter.

By Nadeem Walayat

http://www.marketoracle.co.uk

Copyright © 2005-09 Marketoracle.co.uk (Market

Oracle Ltd). All rights reserved.

Nadeem Walayat has over 20 years experience of trading

derivatives, portfolio management and analysing the financial

markets, including one of few who both anticipated and Beat the

1987 Crash. Nadeem's forward looking analysis specialises

on the housing market and interest

rates. Nadeem is the Editor of The Market Oracle, a FREE Daily

Financial Markets Analysis & Forecasting online publication. We

present in-depth analysis from over 400 experienced analysts on a range

of views of the probable direction of the financial markets. Thus

enabling our readers to arrive at an informed opinion on future market

direction. http://www.marketoracle.co.uk

Known as Dr. Doom, the NYU economics professor saw the

mortgage-related meltdown coming.

We

are in the middle of a very severe recession that's going to continue

through all of 2009 - the worst U.S. recession in the past 50 years.

It's the bursting of a huge leveraged-up credit bubble. There's no

going back, and there is no bottom to it. It was excessive in

everything from subprime to prime, from credit cards to student loans,

from corporate bonds to muni bonds. You name it. And it's all reversing

right now in a very, very massive way. At this point it's not just a

U.S. recession. All of the advanced economies are at the beginning of a

hard landing. And emerging markets, beginning with China, are in a

severe slowdown. So we're having a global recession and it's becoming

worse.

Things are going to be awful for everyday people. U.S.

GDP growth is going to be negative through the end of 2009. And the

recovery in 2010 and 2011, if there is one, is going to be so weak -

with a growth rate of 1% to 1.5% - that it's going to feel like a

recession. I see the unemployment rate peaking at around 9% by 2010.

The value of homes has already fallen 25%. In my view, home prices are

going to fall by another 15% before bottoming out in 2010.

For

the next 12 months I would stay away from risky assets. I would stay

away from the stock market. I would stay away from commodities. I would

stay away from credit, both high-yield and high-grade. I would stay in

cash or cashlike instruments such as short-term or longer-term

government bonds. It's better to stay in things with low returns rather

than to lose 50% of your wealth. You should preserve capital. It'll be

hard and challenging enough. I wish I could be more cheerful, but I was

right a year ago, and I think I'll be right this year too.

Entering the Greatest Economic

Depression in History, More Bubbles Waiting to Burst

By: Global_Research

Andrew G. Marshall writes: While

there is much talk of a recovery on the horizon, commentators are

forgetting some crucial aspects of the financial crisis. The crisis is

not simply composed of one bubble, the housing real estate bubble,

which has already burst. The crisis has many bubbles, all of which

dwarf the housing bubble burst of 2008. Indicators show that the next

possible burst is the commercial real estate bubble. However, the main

event on the horizon is the “bailout bubble” and the general world debt