The

Gaping Chasm between Economics and Physics

Rising Systemic Risk and Multiple Black Swans

London, UK - 12th December 2009, 23:05 GMT

Dear ATCA Open & Philanthropia Friends

[Please note that the views presented by individual contributors are not necessarily representative of the views of ATCA, which is neutral. ATCA conducts collective Socratic dialogue on global opportunities and threats.]

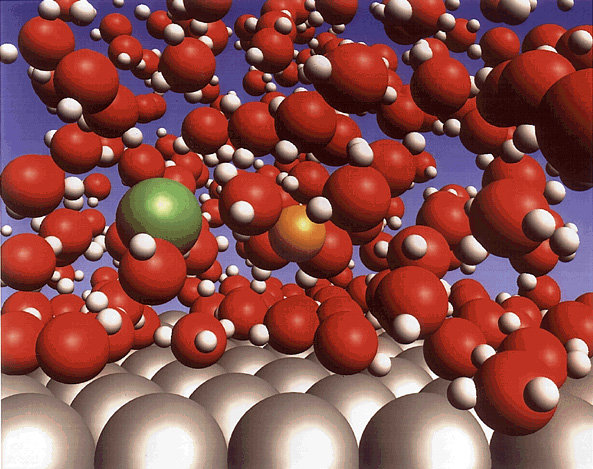

Thermodynamics

Does today's dominant economic and financial thinking violate the laws of physics? Mainstream finance and economics have long been inconsistent with the underlying laws of thermodynamics, which are fast catching up as a result of globalisation! At present, economics is the study of how people transform nature to meet their needs and it treats the exploitation of finite natural resources including energy, water, air, arable land and oceans as externalities, which they are not! For example, we cannot pollute and damage natural ecosystems and their local communities ad infinitum without severe repercussions to their underlying sustainability. It is widely recognised both within the distinguished ATCA community and beyond that exchange rates instability, equity and commodity market speculation -- particularly fuel, food and finance -- and resultant volatilities as well as external debt are the main cause of asymmetric threats and disruption at the international level manifest as known unknowns, ie, low probability high impact risks and unknown unknowns or black swans.

There is a fundamental conflict between economic growth and environmental protection, including conservation of biodiversity, clean air and water, and atmospheric stability. This conflict is due to the laws of thermodynamics. An economic translation of the first law of thermodynamics is that we cannot make something from nothing. All economic production must come from resources provided by nature. Also, any waste generated by the economy cannot simply disappear. At given levels of technology, therefore, economic growth entails increasing resource use and waste in the form of pollution. According to the second law of thermodynamics, although energy and materials remain constant in quantity, they degrade in quality or structure. This is the meaning of increasing entropy. In the context of the economy, whatever resources we transform into something useful must decay or otherwise fall apart to return as waste to the environment. The current model of the disposable economy operates as a system for transforming low-entropy raw materials and energy into high-entropy toxic waste and unavailable energy, while providing society with interim goods and services and the temporary satisfaction that most deliver. Any such transformations in the economy mean that there will be less low-entropy materials and energy available for natural ecosystems. Mounting evidence of this conflict demonstrates the limits to our global growth!

Where do massive turbulences actually come from and what is the underlying cause of periodic financial and economic crises with accelerating levels of severity at national and trans-national levels? Mainstream economics is fundamentally flawed in its measurement of: 1. The value of human capital; 2. The real long term cost of renewal of natural ecosystems and resources; and 3. The overall health of the economy as assessed by Gross Domestic Product (GDP). The near-universal quest for constant economic growth -- translated as rising GDP -- ignores the world's diminishing supply of natural resources at humanity's peril, failing to take account of the principle of net Energy Return On Investment (EROI). The Great Reset -- the protracted 21st century financial and economic crisis and global downturn which ATCA originally labelled as The Great Unwind in 2007 -- has led to much soul-searching amongst economists and policy makers, the vast majority of whom never saw it coming because they never understood that the credit pyramid is an inversion of the energy-dependence pyramid.

When we look beyond the narrow lens of the current human perspective, survival of all living creatures -- including ourselves -- is limited by the concept of Energy Return on Investment (EROI). What does EROI really mean? Any living thing or living societies can survive only so long as they are capable of getting more net energy from any activity than they expend during the performance of that activity. This simple concept is ignored by present-day economics when focussing solely on demand and supply curves or daily financial market gyrations. For example, if a human burns energy eating food, that food ought to give that person more energy back then s/he expended, or the person will not survive. It is a golden rule that lies at the core of studying all flora and fauna, whether they are micro-organisms, thousand year old trees or mighty elephants. Human society should be looked at no differently: even technologically complex societies are still governed by the EROI and the laws of thermodynamics!

The petroleum sector's EROI in USA was about 100-to-1 in the 1930s, meaning one had to burn approximately 1 barrel of oil's worth of energy to get 100 barrels out of the ground. By the 1990s, that number slid to less than 36-to-1, and further down to 19-to-1 by 2006. It has fallen even further in 2009. Oil extraction has evolved by leaps and bounds since the early 1900s, and yet companies must expend much more energy to get less and less oil than they did a hundred years ago. If one were to go from using a 19-to-1 energy return on fuel down to a 3-to-1 EROI, economic disruption is guaranteed as nothing is left for other economic activity at all!

Is it because we don't have the technology that we find ourselves cornered? No. Technology is in a global race with rocketing energy consumption and accelerating depletion of energy, and that's a very complex set of challenges to confront simultaneously. The resource constraints foreseen by the Club of Rome in 1972 are more evident today than at any time since the publication of the think tank's famous book, "The Limits to Growth" which stated: "If the present growth trends in world population, industrialisation, pollution, food production, and resource depletion continue unchanged, the limits to growth on this planet will be reached sometime within the next one hundred years. The most probable result will be a rather sudden and uncontrollable decline in both population and industrial capacity."

Although more than 60 years have elapsed since The Great Depression of the 1930s and the subsequent horrors of the second world war, our understanding of severe economic downturns has improved very little in the 20th and 21st centuries. Economists, financiers, and policy makers are too often at a loss when asked to provide a diagnosis and propose a remedy for the reoccurrence of complex systemic risk. The main problem with mainstream economics is that it treats energy as the same as any other commodity input in the production function, thinking of it purely in money terms, and treating it the same as they would other raw materials and sub-components, but without energy, one can't have any of the other inputs or outputs! We have to begin regarding Calories, Joules and Watts as the key currencies rather than the Dollar, Euro and Yen!

Is lowering the carbon footprint as Copenhagen would have us believe, the only answer, or is conservation of energy efficiency another important thread in the global solution that we all seek? Neither would be sufficient at our present rate of accelerating energy consumption worldwide! The International Energy Agency's data shows that global energy use is doubling every 37 years or so, while energy productivity takes about 56 years to double! Energy and resource conservation is somewhat pointless in the mainstream economic system as it is now legislated and operates. Whilst such efforts are noteworthy as they buy the world a bit more time -- as Copenhagen no doubt will claim -- but the destination is inevitably unaltered! A barrel of oil not burned by an American or European will be burned by someone else in another emerging country as that nation seeks to topple its rival in the high GDP growth league!

What is needed is a unified working model consistent with the nature of Energy Return on Investment (EROI) and capable of accounting for the process of all types of capital accumulation, treatment of externalities as internalities, mapping global energy flows and their circulation. In 1926, Frederick Soddy, a chemist who was awarded the Nobel Prize just a few weeks before, published "Wealth, Virtual Wealth and Debt," one of the first books to argue that energy should lie at the heart of economics and not supply-and-demand curves. Soddy was critical of traditional monetary policy for seemingly ignoring the fact that "real wealth" is derived from using energy to transform physical objects, and that these physical objects are inescapably subject to the laws of thermodynamics, or inevitable decline and disintegration.

The main problem is that we as a global society, even in 2009, are almost incapable of detecting and measuring systemic risk in a complex system as we have seen in the global financial and economic crises: The Great Unwind and The Great Reset. Given this inability, what we tend to do, is to focus on a single cause -- such as capping carbon emissions at Copenhagen -- and extrapolate out of that a wider perspective which has the capacity to lead to an incomplete and distorted view. A new model of economics must aim to contribute to the development of the scientific understanding of the way our economic systems work holistically, with particular reference to inherent monetary disequilibria caused by energy, water, air, arable land and natural resources dependence and how those could practically be dealt with via modern physics.