| New Keynesian economics | |

|---|---|

|

|

| Birth | February 9, 1943 |

| Nationality | United States |

| Field | Macroeconomics, Public Economics, Information Economics |

| Influences | John Maynard Keynes, Robert Solow |

| Influenced | Jason Furman |

| Contributions | Screening, Taxation, Unemployment |

| Information at IDEAS/RePEc | |

|

|

|

|---|---|

| In office 1995 – 1997 |

|

| President | Bill Clinton |

| Preceded by | Laura Tyson |

| Succeeded by | Janet Yellen |

|

|

|

Joseph Eugene Stiglitz (born February 9, 1943) is an American economist and a professor at Columbia University. He is a recipient of the Nobel Memorial Prize in Economic Sciences (2001) and the John Bates Clark Medal (1979). He is also the former Senior Vice President and Chief Economist of the World Bank. He is known for his critical view of the management of globalization, free-market economists (whom he calls "free market fundamentalists") and some international institutions like the International Monetary Fund and the World Bank. In 2000, Stiglitz founded the Initiative for Policy Dialogue (IPD), a think tank on international development based at Columbia University. Since 2001, he has been a member of the Columbia faculty, and has held the rank of University Professor since 2003. He also chairs the University of Manchester's Brooks World Poverty Institute and is a member of the Pontifical Academy of Social Sciences. Stiglitz is one of the most frequently cited economists in the world. [1]

Contents[hide] |

Stiglitz was born in Gary, Indiana, to Jewish parents, Charlotte and Nathaniel Stiglitz. From 1960 to 1963, he studied at Amherst College, where he was a highly active member of the debate team and President of the Student Government. He went to the Massachusetts Institute of Technology (MIT) for his fourth year as an undergraduate, where he later pursued graduate work. His undergraduate degree was awarded from Amherst College. From 1965 to 1966, he moved to the University of Chicago to do research under Hirofumi Uzawa who had received an NSF grant. He studied for his PhD from MIT from 1966 to 1967, during which time he also held an MIT assistant professorship. The particular style of MIT economics suited him well - simple and concrete models, directed at answering important and relevant questions.[2] From 1969 to 1970, he was a Fulbright research fellow at the University of Cambridge. In subsequent years, he held professorships at Yale University, Stanford University, Duke University, Oxford University and Princeton University. Stiglitz is now a Professor at Columbia University, with appointments at the Business School, the Department of Economics and the School of International and Public Affairs (SIPA), and is editor of The Economists' Voice journal with J. Bradford DeLong and Aaron Edlin. He also gives classes for a double-degree program between Sciences Po Paris and Ecole Polytechnique in 'Economics and Public Policy'. As of 2005 he chairs The Brooks World Poverty Institute at the University of Manchester.[3][4] Stiglitz is generally considered to be a New-Keynesian economist[clarification needed].

In addition to making numerous influential contributions to microeconomics, Stiglitz has played a number of policy roles. He served in the Clinton Administration as the chair of the President's Council of Economic Advisors (1995 – 1997). At the World Bank, he served as Senior Vice President and Chief Economist (1997 – 2000), in the time when unprecedented protest against international economic organizations started, most prominently with the Seattle WTO meeting of 1999. He was fired by the World Bank for expressing dissent with its policies.[5] He was a lead author for the Intergovernmental Panel on Climate Change.

He is a member of Collegium International, an organization of leaders with political, scientific, and ethical expertise whose goal is to provide new approaches in overcoming the obstacles in the way of a peaceful, socially just and an economically sustainable world.

Stiglitz has advised American President Barack Obama, but has also been sharply critical of the Obama Administration's financial-industry rescue plan.[6] Stiglitz said that whoever designed the Obama administration's bank rescue plan is “either in the pocket of the banks or they’re incompetent.” [7]

| This section cites its sources but does not provide page references. You can help to improve it by introducing citations that are more precise. |

Stiglitz's most famous research was on screening, a technique used by one economic agent to extract otherwise private information from another. It was for this contribution to the theory of information asymmetry that he shared the Nobel Memorial Prize in Economics[2] in 2001 "for laying the foundations for the theory of markets with asymmetric information" with George A. Akerlof and A. Michael Spence.

Traditional neoclassical economics literature assumes that markets are always efficient except for some limited and well defined market failures. More recent studies by Stiglitz and others reverse that presumption: It is only under exceptional circumstances that markets are efficient. Stiglitz has shown (together with Bruce Greenwald) that "whenever markets are incomplete and /or information is imperfect (which are true in virtually all economies), even competitive market allocation is not constrained Pareto efficient". In other words, there almost always exists schemes of government intervention which can induce Pareto superior outcomes, thus making everyone better off.[8] Although these conclusions and the pervasiveness of market failures do not necessarily warrant the state intervening broadly in the economy, it makes clear that the "optimal" range of government recommendable interventions is definitely much larger than the traditional "market failure" school recognizes[9] For Stiglitz there is no such thing as an "invisible hand".[10]

In the opening remarks for his prize acceptance "Aula Magna",[12] Stiglitz said:

In an interview, Stiglitz explained further:

Stiglitz also did some research on efficiency wages, and helped create what became know as the "Shapiro-Stiglitz model" to explain why there is unemployment, why wages are not bid down sufficiently by job seekers (in the absence of minimum wages) so that everyone who wants a job finds one, and to question whether the neoclassical paradigm could explain involuntary unemployment.[14] The answer to these puzzles was proposed by Shapiro and Stiglitz in 1984: "Unemployment is driven by the information structure of employment".[14] Two basic observations undergird their analysis:

A full description of this model can be found at the links provided.[15] Some key implications of this model are:

The outcome is never Pareto efficient.

|

|

This article may require cleanup to meet Wikipedia's quality standards. Please improve this article if you can. (December 2008) |

While the mathematical validity of Stiglitz et al. theorems are not in question, their practical implications in political economy and their application in real life economic policies have been subject to considerable debates and disagreements[16]. Stiglitz himself seems to be continuously adapting his own political-economic discourse,[17] as we can see from the evolution in his positions as initially stated in Whither Socialism? (1994) to his own new positions held on his most recent publications.

The objections to the wide adoption of these positions suggested by Stiglitz's discoveries do not come from economics itself but mostly from political scientists and are in the fields of sociology. As David L. Prychitko discusses in his "critique" to Whither Socialism? (see below), although Stiglitz's main economic insight seems generally correct, it still leaves open great constitutional questions such as how the coercive institutions of the government should be constrained and what the relation is between the government and civil society.[20]

Stiglitz joined the Clinton Administration in 1993[21], serving first as a member during 1993-1995, and then as Chairman of the Council of Economic Advisers during 1995-1997, in which capacity he also served as a member of the cabinet. He became deeply involved in environmental issues, which included serving on the Intergovernmental Panel on Climate Change, and helping draft a new law for toxic wastes (which was never passed).

Stiglitz's most important contribution in this period was helping define a new economic philosophy, a "third way", which recognized the important, but limited, role of government, that unfettered markets often did not work well, but that government was not always able to correct the limitations of markets. The academic research that he had been conducting over the preceding 25 years provided the intellectual foundations for this "third way".

When President Bill Clinton was re-elected, he asked Stiglitz to continue to serve as Chairman of the Council of Economic Advisers for another term. But he had already been approached by the World Bank, to be its senior vice president for development policy and its chief economist.

As the World Bank began its ten-year review of the transition of the former Communist countries to the market economy it unveiled failures of the countries that had followed the International Monetary Fund (IMF) shock therapy policies - both in terms of the declines in GDP and increases in poverty - that were even worse than the worst that most of its critics had envisioned at the onset of the transition. Clear links existed between the dismal performances and the policies that the IMF had advocated, such as the voucher privatization schemes and excessive monetary stringency. Meanwhile, the success of a few countries that had followed quite different strategies suggested that there were alternatives that could have been followed. The U.S. Treasury had put enormous pressure on the World Bank to silence his criticisms of the policies which they and the IMF had pushed.[22][23]

Stiglitz always had a poor relationship with Treasury Secretary Lawrence Summers[24]. In 2000, Summers successfully petitioned for Stiglitz's removal, supposedly in exchange for World Bank President James Wolfensohn's re-appointment – an exchange that Wolfensohn denies took place. Whether Summers ever made such a blunt demand is questionable – Wolfensohn claims he would "have told him to fuck himself".[25]

Stiglitz resigned from the World Bank in January 2000, a month before his term expired.[23] The Bank's president, James Wolfensohn, announced Stiglitz's resignation in November 1999 and also announced that Stiglitz would stay on as "special advisor to the president", and would chair the search committee for a successor.

In this role, he continued criticism of the IMF, and, by implication, the US Treasury Department. In April 2000, in an article for The New Republic, he wrote:

The article was published a week before the annual meetings of the World Bank and IMF and provoked a strong response. It proved too strong for Summers and, yet more lethally, Stiglitz's protector-of-sorts at the World Bank, Wolfensohn. Wolfensohn had privately empathised with Stiglitz's views, but this time was worried for his second term, which Summers had threatened to veto.[citation needed] Stanley Fisher, deputy managing director of the IMF, called a special staff meeting and informed at that gathering that Wolfensohn had agreed to fire Stiglitz. Meanwhile, the Bank's External Affairs department told the press that Stiglitz had not been fired, his post had merely been abolished.[27]

In a September 19, 2008 radio interview with Aimee Allison and Philip Maldari on Pacifica Radio's KPFA 94.1 FM in Berkeley, California, Stiglitz implied that President Clinton and his economic advisors would not have backed the North American Free Trade Agreement (NAFTA) had they been aware of stealth provisions, inserted by lobbyists, that they overlooked.

In July 2000 Stiglitz founded the Initiative for Policy Dialogue (IPD), with support of the Ford, Rockefeller, McArthur, and Mott Foundations and the Canadian and Swedish governments, to enhance democratic processes for decision-making in developing countries and to ensure that a broader range of alternatives are on the table and more stakeholders are at the table.

In 2009, Stiglitz chaired the Commission of Experts on Reforms of the International Monetary and Financial System, informally known as the Stiglitz Commission, which was convened by the President of the United Nations General Assembly "to review the workings of the global financial system, including major bodies such as the World Bank and the IMF, and to suggest steps to be taken by Member States to secure a more sustainable and just global economic order".[28]

Along with his technical economic publications (he has published over 300 technical articles), Stiglitz is the author of books on issues from patent law to abuses in international trade.

In Stability with Growth: Macroeconomics, Liberalization and Development (2006), Stiglitz, José Antonio Ocampo (United Nations Under-Secretary-General for Economic and Social Affairs, until 2007), Shari Spiegel (Managing Director, Initiative for Policy Dialogue - IPD), Ricardo Ffrench-Davis (Main Adviser, Economic Commission for Latin America and the Caribbean - ECLAC) and Deepak Nayyar (Vice Chancellor, University of Delhi) discuss the current debates on macroeconomics, capital market liberalization and development, and develop a new framework within which one can assess alternative policies. They explain their belief that the Washington Consensus has advocated narrow goals for development (with a focus on price stability) and prescribed too few policy instruments (emphasizing monetary and fiscal policies), and places unwarranted faith in the role of markets. The new framework focuses on real stability and long-term sustainable and equitable growth, offers a variety of non-standard ways to stabilize the economy and promote growth, and accepts that market imperfections necessitate government interventions. Policy-makers have pursued stabilization goals with little concern for growth consequences, while trying to increase growth through structural reforms focused on improving economic efficiency. Moreover, structural policies, such as capital market liberalization, have had major consequences for economic stability. This book challenges these policies by arguing that stabilization policy has important consequences for long-term growth and has often been implemented with adverse consequences. The first part of the book introduces the key questions and looks at the objectives of economic policy from different perspectives.The third part presents a similar analysis for capital market liberalization.

Making Globalization Work (2006) surveys the inequities of the global economy, and the mechanisms by which developed countries exert an excessive influence over developing nations. Dr. Stiglitz argues that through tariffs, subsidies, an overly-complex patent system and pollution, the world is being both economically and politically destabilised. Stiglitz argues that strong, transparent institutions are needed to address these problems. He shows how an examination of incomplete markets can make corrective government policies desirable.

Stiglitz argues that economic opportunities are not widely enough available, that financial crises are too costly and too frequent, and that the rich countries have done too little to address these problems. Making Globalization Work[29] had sold more than two million copies.

In 2003, Stiglitz published The Roaring Nineties, his analysis of the boom and bust of the 1990s. In 2004 he published New Paradigm for Monetary Economics (Cambridge University Press) and in 2005, Oxford University Press published his book Fair Trade for All.

In Globalization and Its Discontents (2002), Stiglitz argues that what are often called "developing economies" are, in fact, not developing at all, and puts much of the blame on the IMF.

Stiglitz bases his argument on the themes that his decades of theoretical work have emphasized: namely, what happens when people lack the key information that bears on the decisions they have to make, or when markets for important kinds of transactions are inadequate or don't exist, or when other institutions that standard economic thinking takes for granted are absent or flawed. Stiglitz stresses the point: "Recent advances in economic theory" (in part referring to his own work) "have shown that whenever information is imperfect and markets incomplete, which is to say always, and especially in developing countries, then the invisible hand works most imperfectly." As a result, Stiglitz continues, governments can improve the outcome by well-chosen interventions. Stiglitz argues that when families and firms seek to buy too little compared to what the economy can produce, governments can fight recessions and depressions by using expansionary monetary and fiscal policies to spur the demand for goods and services. At the microeconomic level, governments can regulate banks and other financial institutions to keep them sound. They can also use tax policy to steer investment into more productive industries and trade policies to allow new industries to mature to the point at which they can survive foreign competition. And governments can use a variety of devices, ranging from job creation to manpower training to welfare assistance, to put unemployed labor back to work and cushion human hardship.

Stiglitz complains bitterly that the IMF has done great damage through the economic policies it has prescribed that countries must follow in order to qualify for IMF loans, or for loans from banks and other private-sector lenders that look to the IMF to indicate whether a borrower is creditworthy. The organization and its officials, he argues, have ignored the implications of incomplete information, inadequate markets, and unworkable institutions—all of which are especially characteristic of newly developing countries. As a result, Stiglitz argues, the IMF has often called for policies that conform to textbook economics but do not make sense for the countries to which the IMF is recommending them. Stiglitz seeks to show that these policies have been disastrous for the countries that have followed them.

Whither Socialism? is based on Stiglitz's Wicksell Lectures, presented at the Stockholm School of Economics in 1990 and presents a summary of information economics and the theory of markets with imperfect information and imperfect competition, as well as being a critique of both free market and market socialist approaches (see Roemer critique, op. cit.). Stiglitz explains how the neoclassical, or Walrasian model ("Walrasian economics" refers to the result of the process which has given birth to a formal representation of Adam Smith's notion of the "invisible hand", along the lines put forward by Leon Walras and encapsulated in the general equilibrium model of Arrow-Debreu), may have wrongly encouraged the belief that market socialism could work. Stiglitz proposes an alternative model, based on the information economics established by the Greenwald-Stiglitz theorems.

One of the reasons Stiglitz sees for the critical failing in the standard neoclassical model, on which market socialism was built, is its failure to consider the problems that arise from lack of perfect information and from the costs of acquiring information. He also identifies problems arising from its assumptions concerning completeness.[30]

Whither Socialism? has been subject to various critiques such as those of the Yale professor John E. Roemer,[31] Peter Boettke, the Deputy Director of the James M. Buchanan Center for Political Economy (1996),[32] as well as David L. Prychitko, a professor of economics at Northern Michigan University.[20] According to Prychitko:

"Stiglitz's main insight is generally correct– that the state cannot be ruled out or that it should be ruled in– but leaves open the grand constitutional questions: How will the coercive institutions of the state be constrained? What is the relation between the state and civil society? His book fails on these political aspects because it has not addressed the broader constitutional concerns that James McGill Buchanan Jr.[33] (1975) and other economists have raised."

Stiglitz wrote a series of papers and held a series of conferences explaining how such information uncertainties may have influence on everything from unemployment to lending shortages. As the chairman of the Council of Economic Advisers during the Clinton Administration and former chief economist at the World Bank, Stiglitz was able to put some of his views into action. For example, he was an outspoken critic of quickly opening up financial markets in developing countries. These markets rely on access to good financial data and sound bankruptcy laws, but he argued that many of these countries didn't have the regulatory institutions needed to ensure that the markets would operate soundly.

Stiglitz married for the third time on October 28, 2004, to Anya Schiffrin, who works at the School of International and Public Affairs at Columbia University.

|

|

This article's external links may not follow Wikipedia's content policies or guidelines. Please improve this article by removing excessive or inappropriate external links. (November 2009) |

| Wikiquote has a collection of quotations related to: Joseph Stiglitz |

|

|

This article may contain too much repetition or redundant language. Please help improve it to fix this issue. (November 2009) |

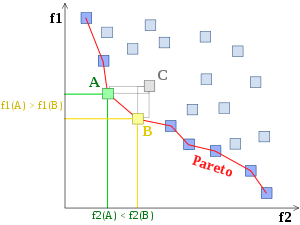

Pareto efficiency, or Pareto optimality, is an important concept in economics with broad applications in game theory, engineering and the social sciences. The term is named after Vilfredo Pareto, an Italian economist who used the concept in his studies of economic efficiency and income distribution. Informally, Pareto efficient situations are those in which any (additional) change to make any person better off is impossible without making someone else worse off.

Given a set of alternative allocations of, say, goods or income for a set of individuals, a change from one allocation to another that can make at least one individual better off without making any other individual worse off is called a Pareto improvement. An allocation is defined as Pareto efficient or Pareto optimal when no further Pareto improvements can be made. Such an allocation is often called a strong Pareto optimum (SPO) by way of setting it apart from mere "weak Pareto optima" as defined below.

Formally, a (strong/weak) Pareto optimum is a maximal element for the partial order relation of Pareto improvement/strict Pareto improvement: it is an allocation such that no other allocation is "better" in the sense of the order relation.

Pareto efficiency does not necessarily result in a socially desirable distribution of resources, as it makes no statement about equality or the overall well-being of a society.[1][2]

Contents[hide] |

A so-called weak Pareto optimum (WPO) nominally satisfies the same standard of not being Pareto-inferior to any other allocation, but for the purposes of weak Pareto optimization, an alternative allocation is considered to be a Pareto improvement only if the alternative allocation is strictly preferred by all individuals (i.e., only if all individuals would gain from a transition to the alternative allocation). In other words, when an allocation is WPO there are no possible alternative allocations whose realization would cause every individual to gain.

Weak Pareto-optimality is "weak[er]" than strong Pareto-optimality in the sense that the conditions for WPO status are "weaker" than those for SPO status: Any allocation that can be considered an SPO will also qualify as a WPO, while the reverse does not hold: a WPO allocation won't necessarily qualify as SPO.

Under any form of Pareto-optimality, for an alternative allocation to be Pareto-superior to an allocation being tested -- and, therefore, for the feasibility of an alternative allocation to serve as proof that the tested allocation is not an optimal one -- the feasibility of the alternative allocation must show that the tested allocation fails to satisfy at least one of the criteria whose conjunction (i.e., whose being true all at once) is necessary and sufficient to render the tested allocation Pareto-optimal. The difference between the weak and strong versions of Pareto-optimality lies in that when considered as a set, the conditions necessary and sufficient to make an allocation weakly Pareto-optimal constitute a mere subset of the set of conditions necessary and sufficient to make an allocation strongly Pareto-optimal. In other words, when one compares the two lists of conditions side by side, one finds that a) the WPO list contains some but not all of the conditions found on the SPO list and b) the WPO list contains no conditions not found on the SPO list). The logical consequence may be paraphrased in both of two ways, the only difference being one of emphasis and resulting from how one distributes the negation: a) Every allocation that satisfies the conjunction of the conditions for SPO status also (and by virtue of its satisfying that conjunction) satisfies the conjunction of the conditions for WPO status, and b) the conjunction of conditions for WPO status disqualifies only a subset of the allocations disqualified by the conjunction of conditions for SPO status. To use the language of combat as a metaphor, the conjunction of conditions for WPO status can "defeat" only a subset of the allocations that the conjunction of conditions for SPO status can "defeat." One may apply the same metaphor to describe the set of requirements for WPO status as being "weaker" than the set of requirements for SPO status. (Indeed, because the SPO set entirely encompasses the WPO set, with respect to any property the requirements for SPO status are of strength equal to or greater than the strength of the requirements for WPO status. Therefore, the requirements for WPO status are not merely weaker on balance or weaker according to the odds; rather, one may describe them more specifically and quite fittingly as "Pareto-weaker.")

An economic system that is Pareto inefficient implies that a certain change in allocation of goods (for example) may result in some individuals being made "better off" with no individual being made worse off, and therefore can be made more Pareto efficient through a Pareto improvement. Here 'better off' is often interpreted as "put in a preferred position." It is commonly accepted that outcomes that are not Pareto efficient are to be avoided, and therefore Pareto efficiency is an important criterion for evaluating economic systems and public policies.

If economic allocation in any system (in the real world or in a model) is not Pareto efficient, there is potential for a Pareto improvement — an increase in Pareto efficiency: through reallocation, improvements to at least one participant's well-being can be made without reducing any other participant's well-being.

In the real world ensuring that nobody is disadvantaged by a change aimed at improving economic efficiency may require compensation of one or more parties. For instance, if a change in economic policy dictates that a legally protected monopoly ceases to exist and that market subsequently becomes competitive and more efficient, the monopolist will be made worse off. However, the loss to the monopolist will be more than offset by the gain in efficiency. This means the monopolist can be compensated for its loss while still leaving an efficiency gain to be realized by others in the economy. Thus, the requirement of nobody being made worse off for a gain to others is met.

In real-world practice, the compensation principle often appealed to is hypothetical. That is, for the alleged Pareto improvement (say from public regulation of the monopolist or removal of tariffs) some losers are not (fully) compensated. The change thus results in distribution effects in addition to any Pareto improvement that might have taken place. The theory of hypothetical compensation is part of Kaldor-Hicks efficiency, also called Potential Pareto Criterion. (Ng, 1983).

Under certain idealized conditions, it can be shown that a system of free markets will lead to a Pareto efficient outcome. This is called the first welfare theorem. It was first demonstrated mathematically by economists Kenneth Arrow and Gerard Debreu. However, the result does not rigorously establish welfare results for real economies because of the restrictive assumptions necessary for the proof (markets exist for all possible goods, all markets are in full equilibrium, markets are perfectly competitive, transaction costs are negligible, there must be no externalities, and market participants must have perfect information). Moreover, it has since been demonstrated mathematically that, in the absence of perfect information or complete markets, outcomes will generically be Pareto inefficient (the Greenwald-Stiglitz Theorem).[3]

Explicit consideration of Pareto-efficiency of economic factors (labor, capital) and value added of sectors is given by Dalimov (2008, 2009). It shows that a pair of the value added and labor income behave within and between regions as a linked pair obeying to the heat equation (i.e. they move as just any gas or a liquid obeying to the heat and/or diffusion equations).

Modification of the heat equation has been found as responsible for the dynamics of the factors for a case of international economic integration. Pareto-efficiency here is considered as most optimal (mathematically) re-allocation of the factors taking place due to economic integration. It fits one of clear definitons of Pareto-optimality applied to economics stating that Pareto-efficiency of economic parameters is achieved if there could be no any other better change of these parameters (Jovanovich, 2005). In other words, there has to be fulfilled a condition of the first spatial derivatives of the factors tending to zero after economic integration.

Economically a starting point for analysis was an idea that labor migrates to place of better wages while capital - to areas with higher returns (as example, consider unification of Germany, with labor moving from east to west, and capital being invested from West Germany to eastern part of the unified state), with direction of respective migration flows being opposite to each other. But the outcome of the analysis has shown that only value added of sectors (not capital) and annual wages of labor act as linked pair of parameters. Economically this means that businesses make value added in less developed integrated areas, while labor still moves to places with higher wages. The other straight conclusion is with the dynamic equation obtained (non-homogeneous heat equation) which for decades has been considered in physics as quite developed tool of analysis. So now one may attempt to use results previously obtained in physics and apply them for variety of tasks concerning migrating parameters in economics.

Generally, Pareto-efficiency in economics is observed when there come measures changing trade environment within considered region (either state or a group of neighbor states). This is a reason why Pareto-efficiency is one of the intrinsic features of economic integration, both theory and practice.

| This section needs additional citations for verification. Please help improve this article by adding reliable references. Unsourced material may be challenged and removed. (November 2007) |

|

|

This section may require cleanup to meet Wikipedia's quality standards. Please improve this section if you can. (November 2007) |

Given a set of choices and a way of valuing them, the Pareto frontier or Pareto set is the set of choices that are Pareto efficient. The Pareto frontier is particularly useful in engineering: by restricting attention to the set of choices that are Pareto-efficient, a designer can make tradeoffs within this set, rather than considering the full range of every parameter.

The Pareto frontier is defined formally as follows..

Consider a design space with n

real parameters, and for each design-space point there are m

different criteria by which to judge that point. Let  be the function which

assigns, to each design-space point x, a criteria-space point f(x).

This represents the way of valuing the designs. Now, it may be that

some designs are infeasible; so let X be a set of feasible

designs in

be the function which

assigns, to each design-space point x, a criteria-space point f(x).

This represents the way of valuing the designs. Now, it may be that

some designs are infeasible; so let X be a set of feasible

designs in  , which must be a compact

set. Then the set which represents the feasible criterion points is

f(X), the image of the set X under the

action of f. Call this image Y.

, which must be a compact

set. Then the set which represents the feasible criterion points is

f(X), the image of the set X under the

action of f. Call this image Y.

Now construct the Pareto frontier as a

subset of Y, the

feasible criterion points. It can be assumed that the preferable values

of each criterion parameter are the lesser ones, thus minimizing each

dimension of the criterion vector. Then compare criterion vectors as

follows: One criterion vector y strictly dominates (or

"is preferred to") a vector y* if each parameter of y

is no greater than the corresponding parameter of y* and at

least one parameter is strictly less: that is,  for each i and

for each i and  for some i. This

is written as

for some i. This

is written as  to mean that y

strictly dominates y*. Then the Pareto frontier is the set of

points from Y that are not strictly dominated by another point

in Y.

to mean that y

strictly dominates y*. Then the Pareto frontier is the set of

points from Y that are not strictly dominated by another point

in Y.

Formally, this defines a partial order on Y, namely the

(opposite of the) product order on  (more

precisely, the induced order on Y as a subset of

(more

precisely, the induced order on Y as a subset of  ), and the Pareto frontier

is the set of maximal elements

with respect to this order.

), and the Pareto frontier

is the set of maximal elements

with respect to this order.

Algorithms for computing the Pareto frontier of a finite set of alternatives have been studied in computer science. There, this task is known as the maximum vector problem or as skyline query.

An important fact about the Pareto

frontier in economics is that at a Pareto efficient allocation, the marginal rate of substitution

is the same for all consumers. A formal statement can be derived by

considering a system with m consumers and n goods, and

a utility function of each consumer as zi

= fi(xi)

where  is the vector of goods,

both for all i. The supply constraint is written

is the vector of goods,

both for all i. The supply constraint is written  for

for  . To

optimize this problem, the Lagrangian

is used:

. To

optimize this problem, the Lagrangian

is used:

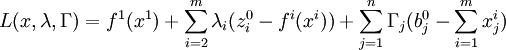

where λ and Γ are

multipliers.

where λ and Γ are

multipliers.

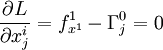

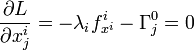

Taking the partial derivative of the Lagrangian with respect to one good, i, and then taking the partial derivative of the Lagrangian with respect to another good, j, gives the following system of equations:

for j=1,...,n.

for j=1,...,n.  for i = 2,...,m

and j=1,...,m, where fx

is the marginal utility on f' of x (the partial derivative

of f with respect to x).

for i = 2,...,m

and j=1,...,m, where fx

is the marginal utility on f' of x (the partial derivative

of f with respect to x).

for i,k=1,...,m

and j,s=1,...,n.

for i,k=1,...,m

and j,s=1,...,n.

Pareto-allocation of the factors may be stated more explicitly and clearly by formulating its definition mathematically as a condition when temporal derivatives of the parameters (economic factors, such as a labor or capital) strive to zero. That means that it is indeed an optimal allocation, identical to Pareto-efficiency condition.

|

|

This section does not cite any references or sources. Please help improve this article by adding citations to reliable sources. Unsourced material may be challenged and removed. (July 2009) |

When Pareto efficiency is used as a tool in politics to determine whether a situation can be improved upon or not, there is no consideration of the equity of resource allocation. It may be that one economic agent owns all of the world's resources; it would be impossible to make anyone else better off without taking something away from this agent. Assuming all resources benefit the rich agent's well-being, this situation is described as "Pareto optimal", even though it may be seen as inequitable.

More generally, it can be misleading, in that "not Pareto optimal" implies "can be improved" (making someone better off without hurting anyone), but "Pareto optimal" does not imply "cannot be improved" by some measure—it only implies that someone must receive less. Thus if an allocation is not Pareto optimal, it means that one can improve it, but does not mean that one should categorically reject it for any arbitrary Pareto optimal solution, as many of those Pareto optimal solutions will not be Pareto improvements.