Sovereign Alchemy Will Fail |

| Egon von Greyerz |

| Matterhorn AM |

When we look at the world economy today, wherever we turn

we see a wall of risk. And sadly this is an insurmountable wall with

risks that are totally unprecedented in history. There has never before

been a potentially catastrophic combination of so many virtually

bankrupt major sovereign states (US, UK, Spain, Italy Greece, Japan and

many more) and a financial system which is bankrupt but is temporarily

kept alive with phoney valuations and unlimited money printing. But

governments will soon realise that they are not alchemists who can turn

printed paper into gold. The consequences of the global financial

crisis are potentially catastrophic.

As the Austrian economist von Mises said: “There is no means of

avoiding the final collapse of a boom brought about by credit

expansion. The alternative is only whether the crisis should come

sooner as the result of a voluntary abandonment of further credit

expansion or later as a final and total catastrophe of the currency

involved.”

In our view, governments like the US and the UK and many

others will not abandon further credit expansion. They are committed to

printing increasing amounts of worthless paper money in order to

finance the growing deficits and the rotten financial system. Therefore there is no

chance of Quantitative Easing ending but instead it will accelerate in

2010 and after. The consequence of this will be a

hyperinflationary depression in many countries due to many currencies

becoming worthless. No economy in the world, including China, will

avoid this severe economic downturn which is likely to have a major

impact on the world economy for many, many years to come.

Investors are ignoring the risks

What makes the current situation in the world economy so

intriguing is that most investment markets have not recognised the

risk. Stockmarkets and bond markets rallied substantially in 2009,

totally oblivious of the risks. The housing market is down in the US

and some European countries like Spain and Ireland. But in many other

countries it is still near the bubble highs created by low interest

rates and reckless lending.

The most important criterion, when taking investment

decisions, is understanding the risks involved. Matterhorn Asset

Management has in the last few years warned investors about the risks

in the financial system due to the massive worldwide credit expansion

and money printing. We have found it difficult to fathom so few people

realise that the world economy has become a time bomb waiting to

explode or more likely implode. All the so called experts have declared

that it is impossible to identify the problems in the financial system

in advance. For example, Greenspan, Bernanke, Geithner, other central

bankers and government officials as well as Blankfein of Goldman Sachs

and many bank heads have all stated that they couldn’t see it coming.

Either they are lying or they are stupid. Sadly, it is most likely the

former. It is virtually impossible to find an honest politician. They

have one major objective – Power. To attain power they have to buy

votes. But to buy votes they cannot tell the truth. No politician ever

forecasts bad news because bad news does not buy votes. (Yes, there are

exceptions like Ron Paul in the US). And as regards the bankers, it is

definitely not in their interest to worry about risks to the financial

system. For every year that they issue additional toxic debt and

derivatives they earn more in that single year than most normal people

earn in a lifetime.

Sovereign Defaults

The list of countries at risk of bankruptcy is increasing

by the day. The acronym used to be PIGS (Portugal, Ireland, Greece and

Spain). It is now PIIGSJUKUS and growing. The main contenders are

currently: USA,

UK, Japan, Spain, Italy, Greece, Ireland, France, Portugal, Baltic

States, Eastern Europe and many more. On a proper

accounting basis all of these countries are already bankrupt, but since

many nations can either print money like the US and the UK or increase

their already high borrowings, like Greece or the Baltic States, they

have technically avoided bankruptcy although in reality all the

countries in the list above are basket cases with very little chance of

a return to normality. Shown below is what we call the Sovereign Time

Bomb. The bomb consists of countries that have a combination of budget

deficit and borrowings relative to GDP which puts them into the

category “Time Bomb” or high risk of default. These countries have

budget deficits from 6% (Italy) to 12.5% (UK, Greece) of GDP and their

Public Sector Debts are ranging from 60% (Spain) to almost 200% (Japan)

of GDP.

The Sovereign Time Bomb

The problem is not just the current debt levels of these

nations, because the deficits in all the countries are rising. Tax

revenues are collapsing and with rapidly rising unemployment, the

governments’ expenses for social charges are soaring. In the US for

example the federal deficit in 2009 was $1.5 trillion (10.7% of GDP)

and is forecast to stay around that level for many years. The plight of

the US states is just as bad. Out of 50 states only 4 are expected to

have a balanced budget in 2010. Up to 40 states, including California,

New York, Florida, Illinois, Michigan, Ohio, North Carolina and New

Jersey, are virtually bankrupt.

It took almost 200 years for US Federal debt to reach $ 1

trillion which it did in 1981. In 2009 the debt increased by $ 1.9

trillion in just that year to $ 12.4 trillion. In the next ten years

the US debt is forecast to reach $ 25 trillion. And this doubling of

the debt does not include any funds to prop up a bankrupt financial

system or the spending of tens or maybe hundreds of trillions of

dollars on worthless OTC derivatives. The forecast also assumes growth

in GDP which is extremely unlikely especially for the next 2-5 years.

Currently US Federal debt is six times what it collects in tax revenue

every year. With debt exploding and tax revenues collapsing, there is

no chance that the debt can ever be repaid with normal money. Also,

with debt out of control interest rates will rise substantially to

10-20% per annum. Applying a 15% interest rate to a $ 25 trillion debt

would give an annual interest bill of $ 3.75 trillion which would be

substantially more than tax revenues.

The chart below shows the US Federal Debt per person. In

the last ten years it has gone from $ 20,000 to $ 40,000. Total US debt, including

private and corporate debt as well as unfunded liabilities, comes to

$430,000 per individual. It is an absolute certainty that every man,

woman and child in the US cannot pay off almost half a million dollars

with normal money. Only massive money printing will take care of that.

With these levels of deficits for the next ten years on

top of an already massive debt, there is no possibility whatsoever that

the US economy can avoid bankruptcy. No country has ever abolished

debts of this magnitude by printing paper and the US will not be the

first one to succeed either.

Only Lose – Lose Options

Governments have two choices – continue to borrow and

print money or reduce government spending. This is a lose – lose

situation and whatever choice they make it will end in disaster.

Countries within the EMU like Greece or Spain are introducing austerity

programmes that forecast their deficits to come down to 3% of GDP which

is the EU maximum deficit limit. These are totally unrealistic targets

that are mainly based on an improvement in the economy which is total

fantasy. The dilemma is that not one single country within the EU is

below the 3% limit, not even Germany. And the effect of the austerity

programmes will lead to such a major contraction of the economies that

tax revenues will collapse, further exacerbating the plight of these

countries.

The alternative is to print or borrow more money.

Printing is not a luxury that individual EMU members have and for these

insolvent countries to borrow money is becoming almost impossible or

very costly. But the European Central Bank can print money and this is

likely to be the path they will initially choose to save Greece and

possibly Spain. Countries like the US and the UK can still borrow and

print money. And this is what they will continue to do. With rising

deficits, rising unemployment and the problems in the financial system

re-emerging they have no choice. Both the UK and the US are set upon a

course of self-destruction. We will see trillions of pounds and dollars

printed in the next few years. But the only buyers of these government

securities will be the US and UK governments. The rest of the world

will dump their holdings which will result in both the dollar and the

pound dropping precipitously and interest rates rising substantially.

Hyperinflation – Consequences

The effect of a collapsing currency will be a

hyperinflationary depression. This is the inevitable outcome for the UK

and US and there is sadly no action that the governments of these

countries can take to alter this course. We discussed the consequences

of this outcome in our July 09 newsletter – “The Dark Years Are Here”.

There will be extreme poverty. None of the social safety nets will

function. So most of the social security payments that people in need

have been used to will disappear or be worthless due to hyperinflation.

There will be severe shortages of food which will lead to famine and

social unrest. Hungry people are restless people that will take the law

into their own hands. This will lead to violent protests, lawlessness,

theft and violent crime. And there is unlikely to be a force of law

that is paid and functional to deal with the problems. Already today,

many US cities and states are cutting down on the police force and

their equipment. This trend will accelerate during 2010 due to budget

cuts and lack of funds.

There will be massive cuts in education and many schools

will close due to lack of resources. Pensioners will be major

sufferers. Many pension plans are unfunded but also the funded ones

will be decimated. Pension funds are invested in three areas –

equities, bonds and real estate. All three are likely to go down by at

least 50% but probably more like 75% at least, all in real terms.

Deflation and Inflation

Most economists and financial analysts disagree with the

hyperinflationary scenario and believe that the deleveraging of debt

will lead to a deflationary downturn. That scenario would be more

likely if countries like the US and UK were not printing endless

amounts of fiat money. As we have explained above the printing presses

will not slow down but they will accelerate in coming years. The UK’s

announcement that they will cease Quantitative Easing is just a

temporary measure that won’t last. Governments detest

deflation because they know that deflation after uncontrolled credit

growth would lead to an implosion of the financial system and the

economy. Virtually all bank loans and OTC derivatives have been issued

against inflated and unsustainable asset values. In a deflationary

economy with falling asset values, falling wages, falling corporate

profits and falling government revenues, there is no possibility that

the massive amount of bank credit outstanding can be serviced or

repaid. Therefore the banking system would not survive due to their

massively inflated balance sheets and low equity. This is why

governments are petrified of deflation after a sustained period of

asset and credit bubbles. So their only option is to print whatever

money is required to stave off deflation. And this is what they will

do. There is absolutely no doubt about it. But they are doing

this in total ignorance of the consequences.

Governments created the financial crisis

The current financial crisis was not created by the

banks. It was created by governments’ irresponsible policies of buying

votes by manipulating the financial system through constant money

printing, especially since the creation of the Fed in 1913 and the

abolition of the gold standard in 1971. In addition they have used

interest policy as a popularity contest thereby creating a totally

artificial market which distorts the normal laws of supply and demand.

It is clearly ludicrous to artificially keep interest rates at 0% and

print massive amounts of money. Neither governments, nor banks

should be allowed to create money out of thin air or interfere with

market forces by artificially setting interest rates. It is this

corrupt manipulation of the financial system and the economy that has

totally destroyed the value of money in the last 100 years. Measured

against gold, the dollar and the pound have declined by 99% since 1913.

This would not have happened if governments had not been allowed to use

the financial system as a voting machine. But sadly this will continue

at an accelerated pace in the next few years. Governments seem totally

incapable of comprehending that they cannot solve the world’s greatest

financial crisis by applying more of the same toxic medicine that

created the problem in the first place.

The prosperity illusion

When you live in the midst of history you don’t realise

that you are part of making extraordinary history. Therefore most

people don’t understand that the last 100 years has been an

extraordinary period in history and even more so the last 20-30 years.

The perceived prosperity and increase in living standards have been

achieved primarily through massive increases in borrowing, both by

governments and by individuals. Take away the enormous debt that has

been created during this period and the world would be a lot poorer.

Alternatively, apply a market rate of interest on the debt. If

governments had not manipulated interest rates and set them at

artificially low levels, the normal forces of supply and demand would

have forced rates considerably higher, most probably in double digits.

The higher rates would have reduced demand for credit and thereby

prevented the credit and asset bubbles that have caused the worldwide

financial crisis. In recent years, Greenspan reduced rates from

6% to 1% between the end of 2000 and 2003. And Bernanke again applied

the only remedy that central bankers know, in addition to printing

money, when he reduced rates from 5% to 0% between 2007 and 2008.

These people seem incapable of understanding that simple laws of supply

and demand would have repaired the economy automatically without their

incompetent and desperate interventions. By leaving monetary policy to

market forces we would have normal recessions and minor booms that

would be totally self-regulating. What the central bankers instead have

created is the most enormous bubble in world history. And sadly like

all bubbles, this one can only end in a disaster of a magnitude that

will affect the world for a very, very long time.

So the last 100 years will be seen in history as an

extraordinary period when governments thought that they had invented a

new economic miracle based on unlimited credit and money printing. But

sadly this miracle will be seen by future historians as another failed

delusional economic theory dreamed up by politicians.

Risk of systemic failure of the financial system

The current financial crisis started due to the

uncontrolled, worldwide debt and asset bubbles. The subprime defaults

were just the first symptom of the lethal concoction of credit and OTC

derivatives that the bankers had constructed for their own personal

gain with no understanding of the risks or the consequences.

Governments and central banks worldwide injected or guaranteed around

$20 trillion just to save the financial system. But the only people who

have benefited from this are the people who caused it. Very little of

these enormous sums went into the real economy. In addition to this

enormous liquidity for the benefit of the banking system, governments

have allowed banks to value their assets at totally false prices not

based on market values but on the hope that they will achieve full

value at maturity. To further assist the banks governments worldwide

have reduced interest rates to zero percent. So with trillions in fresh

liquidity, zero interest rates and valuing assets at fantasy prices,

many banks have produced record profits and paid record bonuses.

Money supply in the US as measured by M3 is collapsing.

The chart below shows how M3 has declined almost 6% year on year. This

particular indicator has been very accurate in forecasting the major

economic downturns in the last 40 years and is now at the same level as

before the 1970s recession.

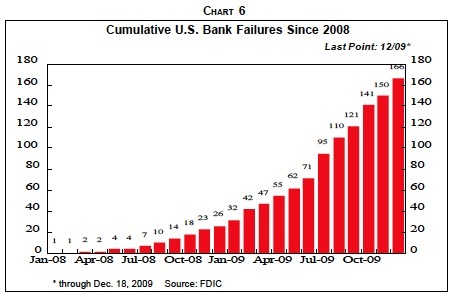

None of the problems that caused the banking crisis in

2007-8 have been solved. They have just been swept under the carpet. In

the US 140 banks failed in 2009 against 25 in 2008 and only 11 banks in

the five preceding years. So far in 2010 a total of 15 banks have

failed and been taken over by the FDIC (Federal Deposit Insurance

Corporation). Virtually all the banks that fail show losses that are

far greater than the balance sheet valuations. Of the circa 6,000 US

banks, a major percentage will fail in the next few years due to

rapidly declining asset values. This will also be the case for many of

the major international banks. If their assets, and in particular their

OTC derivatives were valued at market, very few banks would be solvent

today. In addition, resets of mortgage loans, commercial real estate

loans, credit card loans, private equity loans etc are all problem

areas that could bring major banks down.

The risk of terrorism

Terrorism is an imponderable and it is therefore

impossible to forecast where or when it could happen. With 700 US bases

in 120 countries and with the US, UK and other countries’ involvement

in Iraq and Afghanistan, the alienation that this creates especially in

the Muslim world, poses a major threat of terrorist attacks especially

in the US and UK. The terrorists are almost always ahead of the

intelligence agencies and security services. Therefore it is impossible

to forecast how, where or when the next attack will happen. It could be

planes, it could be shopping centres, or it could be a cyber war

against major international computer networks. The more troops that the

UK and US send to Afghanistan the higher the risks of terrorist acts

against them. The greatest likelihood of preventing or reducing

terrorism would be for the US and the UK to close all foreign military

bases and to withdraw all troops. Sadly, that is a very remote

possibility.

Markets

In January 2009 we forecast that stockmarkets were likely

to correct up to 50% of the down move before continuing the bear

market. The Dow Jones corrected just over 50% but it took a bit longer

than we expected. The correction is now finished and the primary trend

of all stockmarkets is now resuming its downtrend. We are expecting

very substantial falls during 2010. This will not be a year to be

invested in general equities. We expect precious metal shares to do

very well even though initially they will come down with the market.

Bonds

One year ago we predicted that US long bond rates would

rise. This is exactly what happened and the 30 year Treasury Bond yield

went from 2.5% to 4.6% during the year. We expect US and UK bond rates

to continue to rise in 2010. This will be as a result of foreign

holders selling their holdings of these bonds due to the dire economic

situation in the US and UK and the currencies weakening. International

investors are not prepared to finance bankrupt sovereign states without

getting ample reward for the risk.

Currencies

Most people judge currencies on a relative basis. This is

a very poor measure of the value of a currency since it doesn’t take

into account the total destruction of paper money in the last 100

years. We showed in our December report (“Gold is not going up – Paper

Money is going down”) that most major currencies including the dollar,

pound, Dmark/Euro and Yen have all declined 99% against real money –

gold – since the creation of the Fed in 1913. Thus, all currencies are

weak and they will continue to be attacked one at a time. Fundamentally

the dollar is the weakest currency and we would expect the next leg

down to start relatively soon.

The Euro also has its problems and is suffering from the

problems of its weakest members – Greece, Spain, Portugal, Italy, and

Ireland. Like all artificial currencies the Euro was doomed to have a

relatively short life in its original form. We predicted this long

before its birth in Maastricht in 1992. Short term the European

Central Bank will support Greece and all other EU nations that need

support. Longer term, once too much worthless money has been printed by

the ECB without solving the problems, the European Monetary Union is

likely to break up.

But the current fear over Euroland and the weakness of

the Euro relative to the dollar is overdone. The Euro zone budget

deficit to GDP is 6.7% and debt to GDP is 88% whilst the US deficit is

10.7% and debt 92%. So on this basis it is extremely unwise to shift

funds out of the Euro and into US dollars especially since the

underlying fundamental problems are much greater in the US.

All the countries of the major trading currencies – the

Dollar, Euro, Pound and Yen – have major economic problems that can

only be resolved by massive money printing. This is why it is a futile

game to try to predict which currency will be the weakest out of the

above four. They will all weaken substantially but not at the same

time. Therefore, we will have incredible volatility in currency markets

in the next few years whilst speculators lose their shirts jumping from

one currency to the next. There will be very few winners in that game.

So are there any currencies that are better? Yes,

relatively, the Norwegian kroner, the Canadian dollar and possibly the

Swiss Franc and Australian dollar will do better. The Renminbi will

also do well but is difficult to invest in.

Gold

So whilst many paper currencies become virtually

worthless in the next few years, gold will continue to do what it has

done for 6,000 years. It will maintain its purchasing power and

therefore appreciate substantially against all paper currencies.

The recent correction in gold is the weak hands getting

out of speculative positions in the paper gold market. There has been

virtually no selling in the physical market.

So far gold has gone up more than four times in the last

ten years in a stealth market that very few investors have participated

in. The table below shows the extraordinary return that investors in

gold have achieved in the last 5 and 10 years. There is no other asset

during this period that has given such an excellent return whilst at

the same time providing the highest form of wealth protection (provided

it is physical gold).

Average annual return on over 5 and 10 years

|

Period/Currency |

US Dollar |

Pound |

Euro |

Yen |

Swedish Kr. |

|

2000 – 2005 |

9.7% p.a. |

5.2% p.a. |

2.3% p.a. |

8.8% p.a. |

11.0% p.a. |

|

2005 – 2010 |

20.4% p.a. |

25.0% p.a. |

19.1% p.a. |

19.2% p.a. |

19.4% p.a. |

|

2000 – 2010 |

15.1% p.a. |

15.1% p.a. |

10.7% p.a. |

14.0% p.a. |

15.2% p.a. |

Return last 10 years

Over the last 10 years a US and UK investor would have

made an average return on gold of 15.1% per annum.

Return last 5 years

In the last 5 years until the end of 2009, the lowest

annual return on gold was in Euros with 19.1% per annum and the highest

in Pounds with 25% p.a.

These

are absolutely outstanding returns which most investors are totally

oblivious of.

But

the awareness will change in the next few years as gold rises even

faster.

Many investors, including George Soros, who have missed

the bull market in gold (or the bear market in paper currencies), now

believe that gold is overbought and therefore it is too late to invest.

The next chart disproves that theory totally. The chart shows gold in

2009 dollars adjusted for real inflation. Shadowstats.com is a superb

service which analyses government statistics on a true basis, taking

out all adjustments, revisions and other manipulations. Applying the

true inflation rate on the gold price shows that the gold high in 1980

of $ 850 in today’s terms is $ 6,400.

Governments have suppressed the gold price in the last 30

years by both overt operations (official gold sales) and covert

operations (manipulations in the paper gold market and unofficial

sales). Central banks are supposedly holding 30,000 tons of gold but

credible estimates suggest that this figure is around 15,000 which

means that 15,000 tons of central bank gold has been sold covertly to

depress the price. But the effect of manipulation of any market has a

limited time span, especially if it is done in connection with a total

mismanagement of the economy. Central banks have now stopped official

sales and China, India, Russia and many other countries are major

buyers. Production is falling steadily and investment demand is

soaring. With the fundamentals so much in gold’s favour, it should have

no problem to reach the 1980 inflation adjusted high of $ 6,400. With

inflation or hyperinflation gold will go a lot higher than that.

During the next phase up in gold which we expect to start

within the next few weeks, main stream investors will discover what

only a few investors have understood in the last ten years, namely that

physical gold is one of the very few ways to protect their assets and

preserve capital.

Egon von Greyerz

Mattherhorn Asset Management

AG

Matterhorn Asset Management has set up a separate Gold

Division called GoldSwitzerland (www.goldswitzerland.com) in

order for investors to purchase physical gold at very competitive

prices and store it in their own name in Zurich, Switzerland outside

the banking system and with personal access to their own gold bars.